Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 19 Apr 2024

Final Expense Insurance is a form of life insurance that covers end-of-life expenses such as funeral expenses, cremation costs, a cemetery plot, and any remaining medical or legal expenses that would typically be settled by your beneficiary.

In general, what you can expect from a Final Expense Insurance policy is:

- Whole life insurance

- Cash value

- Fixed premiums as long as they are paid

- Previous health issues are ok

- Easy application process

- Same day approvals

- Competitive rates

Funeral Costs at a Glance

With funeral costs rising every year, it can be hard to know how to plan for a funeral or even how much to set aside for essentials such as caskets, burial plots, and more.

In fact, a recent study from the NFDA shows that since 2017, funeral costs have risen over 6% and the median cost of a funeral with cremation has increased to over 11%.

As of 2023, the average funeral ranges from $8,000 – $10,000 (in some states as high as $14,000).

The total cost, however, depends on where you live, and services selected.

Here is an example of what you may pay for different services when planning a funeral.

- Funeral service fee: $2,300

- Funeral home rental: $450

- Funeral home staff for viewing: $450

- Funeral home staff for ceremony: $515

- Vault: $1,572

- Cremation casket: $1,310

- Embalming: $775

- Urn: $295

- Cosmetic services: $275

- Hearse: $350

- Transportation of remains: $350

- Transportation for the family: $150

- Pamphlets and materials: $183

Now, you may be thinking “what if I just get a cremation and don’t have a funeral?” While this may seem like a money-saver, you actually end up paying on average $1,000 – $5,000 depending on the services chosen, as well as what state you live in

What does this mean for you?

With funeral and cremation costs rising significantly in just the past 5 years, this means it will be substantially more in the next 10-15 years.

And most of those expenses get passed on to your family or loved ones.

What other end of life expenses could be left behind?

Often-times funeral expenses are not the only financial responsibilities that fall on your loved ones. Bills such as medical, legal, utility and other debts could be left for loved ones to pay. These end-of-life expenses are often overlooked when planning a funeral.

That being said, it makes financial sense to have a policy in place that covers not only funeral costs, but also end-of-life expenses.

How Does Final Expense Insurance Help?

While funeral costs and final expenses can be expensive, there’s a way that you can not only save money, but also relieve the burden that may be put on your family or loved ones.

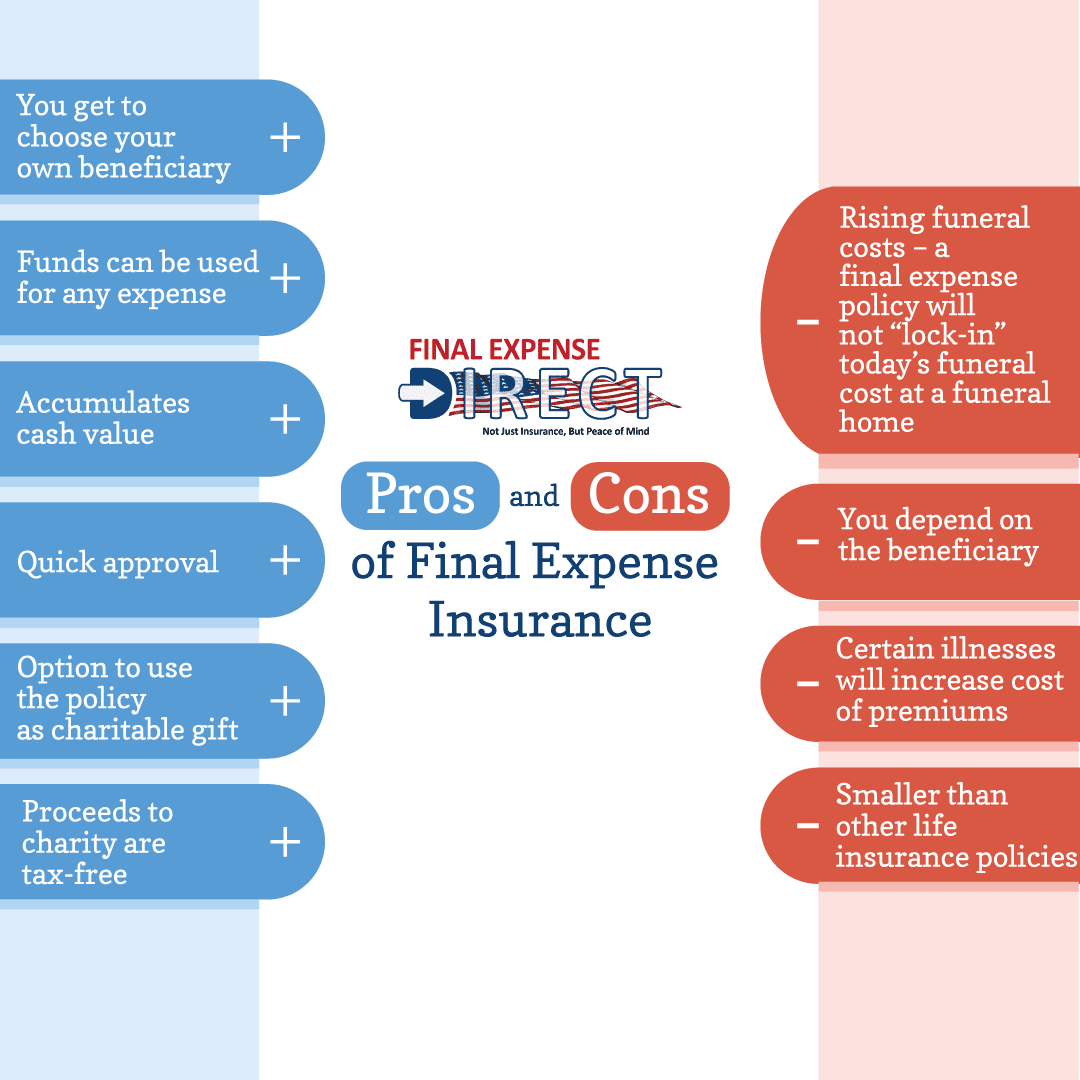

Let’s get into the Pros and Cons Of Final Expense Insurance:

Pros:

There are many benefits to having a final expense policy, here are the top 6:

You get to choose your own beneficiary:

With Final Expense Insurance, you get to not only name who gets the funds and fulfills your final wishes, but you can also name a secondary or contingent beneficiary in a situation where you outlive your primary beneficiary.

Your premiums never increase once you’ve locked in your rate

Final Expense plans do not expire

Funds can be used for any expense:

Other than funeral costs, the money left to beneficiaries can be used for any expense. This means the beneficiary can cover expenses such as outstanding bills, debts, family needs, and more.

Final Expense Insurance accumulates cash value:

Over time, a final expense policy will build cash value. In addition, unlike term policies, final expense benefits don’t expire.

Fast approval:

Most final expense policies have a fast approval process and also do not require a medical exam. In addition, plans are made as simple as possible, and claims are paid quickly.

Option to use the policy as a charitable gift to children or grandchildren:

Oftentimes parents will opt to leave the money behind to children or grandchildren who depend on them for financial support, or to be used as a legacy of love.

Cons:

While the benefits certainly outweigh the cons, there are circumstances where final expense insurance may not be helpful:

Funeral costs are on the rise:

As mentioned earlier, funeral costs are steadily rising which means a final expense policy doesn’t “lock-in” today’s prices at a funeral home.

This is why getting a final expense policy as early as possible is best because it allows the beneficiary to use the funds accumulated towards other expenses that may make end-of-life expenses more expensive.

You depend on the beneficiary:

Make sure you choose your beneficiary wisely because you have to rely on him or her to execute your funeral plans. Make sure they fully understand your final wishes.

Certain illnesses will cause higher premiums:

Final expense insurance is ok with pre-existing conditions but having certain illnesses or medical conditions that you have pre-approval will cause your premiums to be slightly higher.

If you have any newly acquired illnesses after approval, your rate will not be affected.

This is why acting now and getting final expense insurance before your health changes is important.

Smaller than other life insurance:

Because the policies are designed for Final Expenses, they are typically smaller in death benefit than standard whole-life or term policies.

However, they will do what they are designed to do; soften the financial burden that comes with planning a funeral.

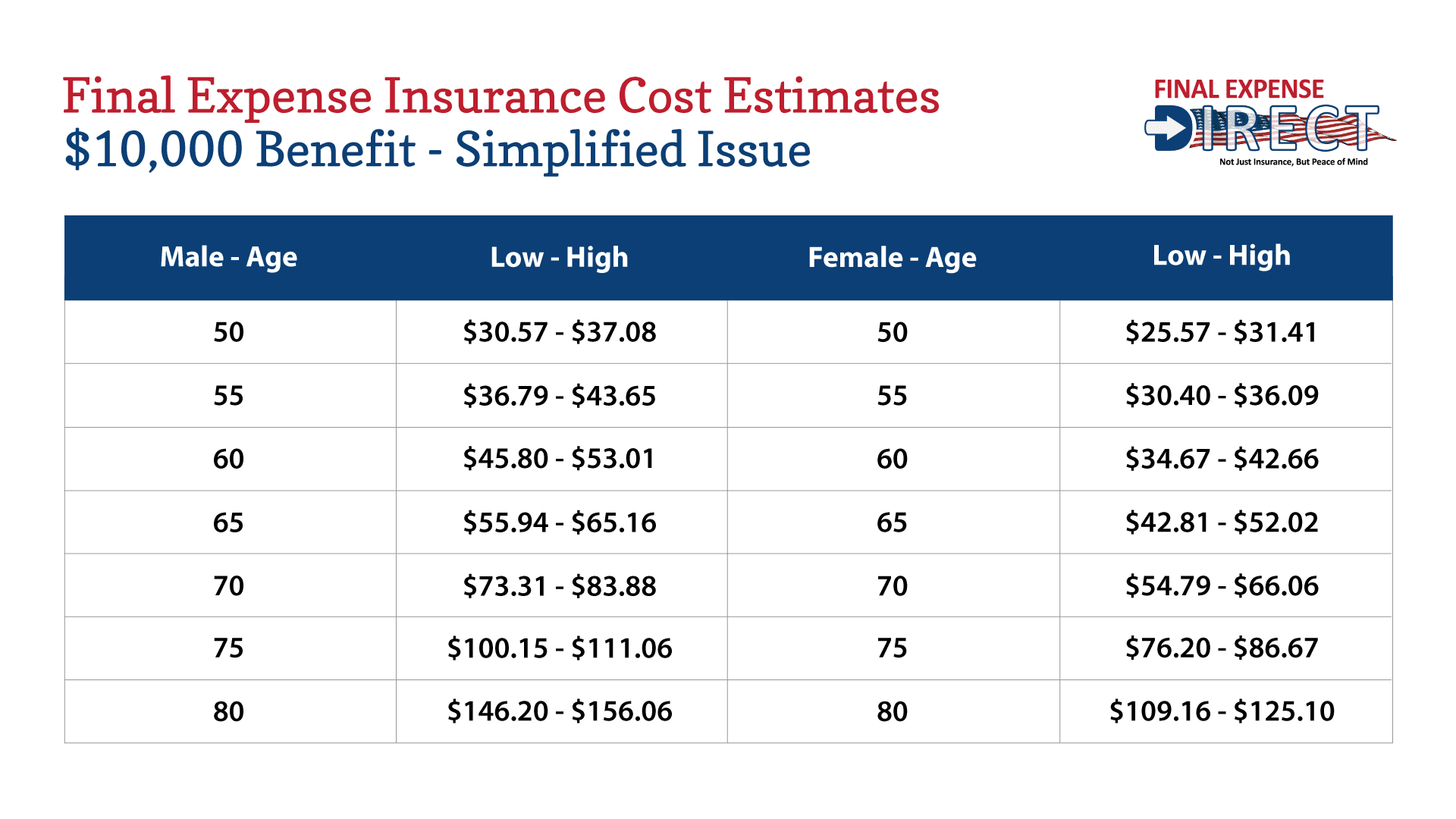

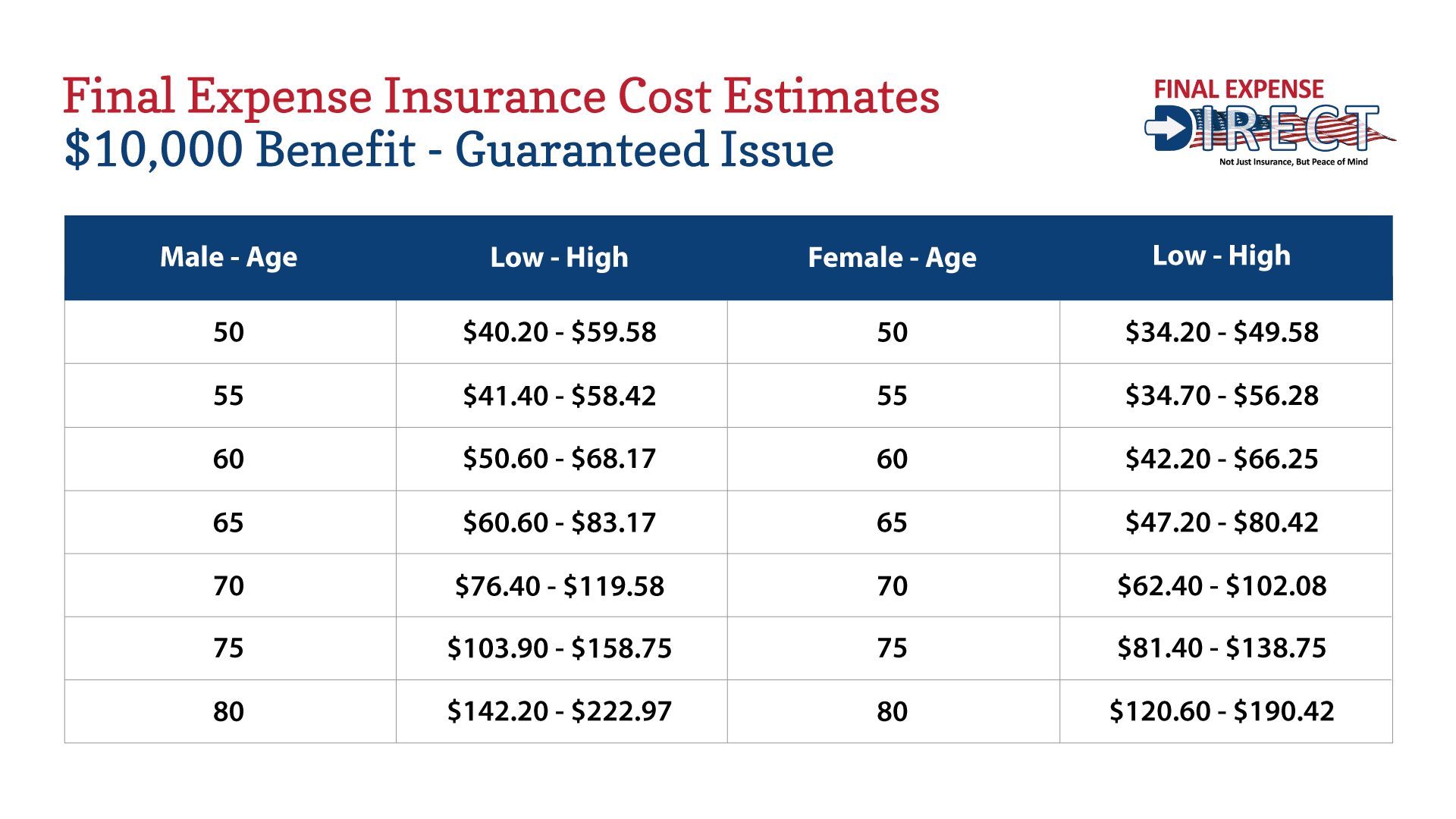

Final Expense Insurance Rates at a Glance:

While every final expense policy is different, there are general ranges you can expect to pay when looking at getting a policy.

Most final expense policies are broken down by age, gender, and type of plan to help determine how much you can expect to pay and receive through your premiums and benefits.

Here are charts that explain final expense insurance rates by age and gender:

While these rates apply to simplified issue and guaranteed issue, as you can see, the older you get, the more you can expect to pay.

At the same time, you’ll end up receiving more for less money the earlier you sign up.

This is why getting a final expense policy as early as possible is ideal.

Why You Need a Final Expense Policy:

With funeral costs and inflation steadily rising, there are many reasons to get final expense insurance.

One of the most common reasons we see people get final expense insurance is to lessen the financial burden that their loved ones go through after they pass.

Another reason to get a final expense policy is if you have been denied insurance coverage or you don’t qualify for term life insurance.

At Final Expense Direct, you can expect to always be accepted for insurance even without a medical exam or if you may not qualify for term insurance.

Another reason to get a final expense policy is if you have one or more serious health issues and/or you need a small amount of coverage.

Since you don’t need a medical exam for final expense insurance, you can actually be quickly approved for coverage even if you have medical problems.

And if you only want enough to pay for funeral expenses or just want to loosen the financial burden on your loved ones, final expense insurance can give you just the coverage you need.

What’s the Difference Between Final Expense Insurance and Life Insurance?

Each life insurance policy has its own set of pros and cons and your needs will determine which one is right for you.

With life insurance, the difference is what is covered and focused on.

For example, final expense insurance puts an emphasis on funeral costs and end-of-life expenses.

However, there are 3 different versions of final expense insurance:

- Immediate Benefit final expense insurance: This doesn’t have a waiting period and is the most exclusive of the 3 types. It is reserved for those with no current or recent health conditions of a serious nature.

- Modified final expense insurance: This is normally reserved for those with current or recent semi-serious health conditions. This insurance usually has a waiting period of 2 years for death by illness. However, death by accident pays immediately.

- Guaranteed issue final expense insurance: This is normally for people that have current or recent health conditions of a serious nature. It normally has a two-year waiting period reserved for death by illness. However, death by accident pays immediately.

Understanding the different types of final expense insurance policies, here are the different types of life insurance policies and how they compare:

Final Expense Insurance vs. Term Life Insurance

You may have read the benefits of final expense insurance and think that it’s the same as term life insurance.

And while they do have some similarities, they’re quite different.

For example, when joining a term life insurance policy, there are close evaluations on the health status of the individual to determine insurability.

With final expense insurance, there are no medical exams, only medical questions.

This means that a preexisting condition won’t disqualify you from being insured whereas with term life insurance, it will.

Another big difference is how each type of insurance is split.

Final expense insurance is split into 3 different types:

- Traditional Immediate Benefit

- Graded/Modified

- Guaranteed Issue

Whereas term insurance is split into:

- Yearly Renewable

- Level Term

- Decreasing term

Simplified Final Expense Insurance vs. Standard Whole Life Insurance

Another popular type of life insurance is whole life insurance!

For many people, whole life insurance can seem like a popular option at first but there are some disadvantages that standard whole life has compared to final expense.

The main difference between standard whole life and final expense is who it’s meant for.

Final expense focuses on seniors whereas standard whole life has a broader audience based on how it can be used when the policyholder is still alive.

Another big difference between standard whole life and final expense insurance is qualifying.

Standard whole life insurance is more discriminatory towards it’s qualifying than final expense insurance. Depending on the size of the policy, you may have to provide medical records from your doctor, and/or have someone come to your house to take your blood, and complete a physical.

This means a preexisting condition, any semi-serious health condition, and sometimes even your age can prevent you from being insured.

With final expense insurance, you will always get approved no matter what condition you have.

How do you Apply for Final Expense Insurance?

Most final expense companies require you to meet in person, with Final Expense Direct, you can apply over the phone!

With Final Expense Direct, our process is really simple.

First click on our quote tab

From there, you fill out basic information and then one of our insurance specialists will call you to walk you through the application and answer any questions you might have.

FAQ’s

Final expense insurance can seem overwhelming, but it doesn’t have to be!

It’s completely normal to have questions about how it works, what’s covered, and more.

At Final Expense Direct, we want to make protecting your end-of-life expenses as easy for you and your loved ones as possible. Here are some of the most frequently asked questions that we get.

How Does Final Expense Insurance Work?

Final expense insurance is no different than other insurance policies.

You start by answering a few basic health questions. You’re then provided the rates and coverage amounts that you qualify for. If you like what you hear, you pick the best plan that fits your needs and budget and the application is completed over the phone. Most seniors are able to get approved for their policy the same day!

After you are approved, the premiums are fixed and never increase.

Once you pass, your beneficiary can file a claim and the death benefit is paid to the primary beneficiary once the claim is approved.

Do I have to meet face-to-face in order to be approved or insured for final expense insurance?

There is no face-to-face necessary when getting final expense insurance. At Final Expense Direct, we do everything over the phone.

This makes becoming insured very simple.

Can I Buy Final Expense Insurance for My Parents or Grandparents?

The short answer is “yes.”

While it is common for individuals to take out final expense insurance policies on their aging parents, getting a final expense policy on the behalf of someone else is only possible if there is insurable interest and the insured has to be able to speak with the agent so they are aware the policy is being taken out on them and do a voice or E-signature.

We wrote an article that covers how this works here

What is the Minimum and Maximum Age Someone Can Get Final Expense Insurance?

While most people begin to get final expense insurance around 50 years old, at Final Expense Direct, you can actually obtain a policy at birth.

We always recommend getting final expense insurance as young as possible because your premium rates will be lower at younger ages and will be locked in for life.

As far as maximum age, most people will only be able to get final expense coverage until they’re about 85.

We wrote an article about how ages work with final expense insurance here.

Have You Thought About What’s Next?

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Planning for death can be scary and overwhelming for many people.

We always encourage people looking at getting a final expense policy to consider the financial burden your family or loved ones may face after you pass!

While what you leave behind in benefits may not seem like much, to someone that may be faced with stacking expenses and rising inflation, a death benefit of any kind can make a big difference.

If you are interested in applying for a final expense policy, our team can help!

Click here to get a quote and pick the right policy for your needs and budget.