Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 25 Apr 2024

New York Life Insurance Company has partnered with another very familiar name seniors are well aware of: AARP.

The AARP Life Insurance Program from New York Life was created specifically for people with an AARP membership.

New York Life is one of the most recognized names in the life insurance industry.

It’s been around for 175 years, offering fully underwritten life insurance through its registered agents, like AARP Life Insurance.

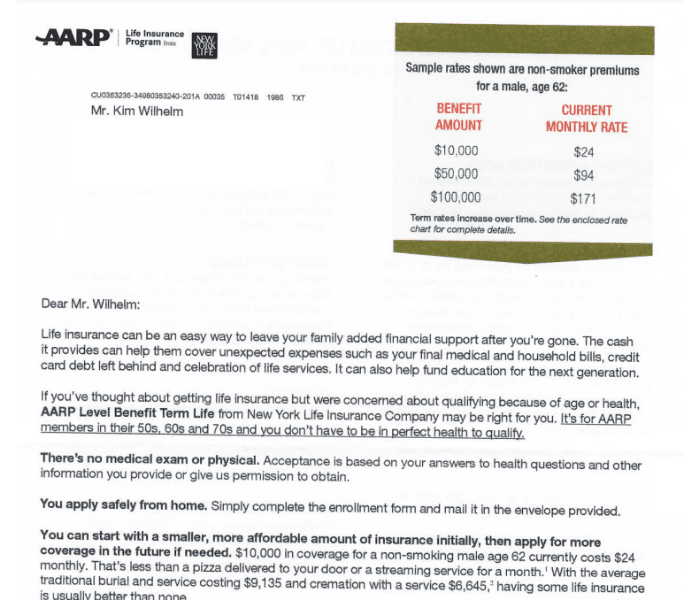

Now, you can get life insurance by New York Life endorsed by AARP at group rates. The AARP Life Insurance Program offers three life insurance options for seniors with the most popular being mailed to you called AARP Level Benefit Term Life.

Sounds great, right? Unfortunately, many are finding out the hard way that it’s not all it’s cracked up to be with AARP charging you way more than their competitors...

Let’s take a deeper look at what the AARP life insurance policy offers to seniors and if it’s the right choice for you.

AARP New York Senior Life Insurance Plans

AARP offers several senior life insurance plan options through New York Life. Your age and health status determine what plans you’re eligible for and how much coverage you can get.

Can Seniors Get Life Insurance Later in Life?

Contrary to popular belief, there are many life insurance policies that cater to seniors.

Whether or not seniors should get life insurance depends on their individual circumstances. Some factors to consider include:

- Financial needs: Do you have any financial obligations that would need to be met in the event of your death? This could include debt, mortgage, college expenses for your children or grandchildren, funeral or burial expenses, and more.

- Health: Are you in good health? If you have any health problems, it may be more difficult to get life insurance or you may have to pay higher premiums.

- Lifestyle: Do you have any hobbies or interests that could incur expenses in the event of your death? This could include travel, sports, or hobbies.

If you have financial needs or obligations that would need to be met in the event of your death, then life insurance may be a good option for you. Even if you don't have any financial obligations, life insurance can still provide peace of mind for your loved ones.

There are a few different types of life insurance that may be a good option for seniors. Term life insurance might be a good option if you need coverage for a specific period of time, such as until your mortgage is paid off or your children are grown. Whole life insurance policies are a good option if you want coverage for your entire life with rates that never increase.

But that doesn't necessarily mean that AARP life insurance for seniors is the best policy. Let's take a closer look at this popular AARP life insurance policy.AARP New York Life Permanent Life Insurance

For seniors with temporary coverage needs, AARP's term life insurance offers a level benefit term life insurance policy from New York Life.

AARP term life policy coverage starts at $10,000, with a maximum of $150,000, or $100,000 if you live in Montana or New York. Term life protection lasts until age 80.

However, unlike other companies offering level premiums on term life, AARP New York Life doesn’t. So expect to get low rates initially, then have them increase every five years if you take out AARP term life insurance.

AARP New York Life Guaranteed Acceptance Life Insurance

If you’re in poor health and can’t qualify for permanent life insurance, AARP New York Life also has a guaranteed acceptance coverage option.

The AARP guaranteed acceptance life insurance product has no medical exam or health questions, and your acceptance is guaranteed. Of course, rates will be higher than forpermanent whole life insurance.

And the maximum coverage amount for guaranteed acceptance whole life insurance is$25,000, and it has a 2-year waiting period on the death benefit.

What's the Difference Between a Whole Life Insurance Policy and a Term Life Insurance Policy?

To summarize, there are several differences between a whole life insurance policy and a term life insurance policy.

AARP Term Life Insurance

- AARP term life insurance is a temporary policy that provides coverage for a specific period of time, such as 10, 15, or 20 years.

- The policy will pay out a death benefit to your beneficiaries if you die during the term of the policy.

- The premium for AARP term life insurance is typically lower than the premium for AARP whole life insurance.

- AARP term life insurance does not build cash value.

AARP Whole Life Insurance

- AARP whole life insurance is a permanent policy that provides coverage for your entire life.

- The policy will pay out a death benefit to your beneficiaries when you die.

- The premium for AARP whole life insurance is typically higher than the premium for AARP term life insurance.

- AARP whole life insurance builds cash value that can be used to pay missed premiums or for other financial needs.

AARP New York Life Rider Benefits

If you buy less than the maximum term life coverage AARP New York Life offers, you can increase to the maximum $150,000 coverage through the AARP Term Rider Protect Plus.

You can also convert up to the maximum coverage from term to whole life if you need permanent coverage. The Guaranteed Exchange Option rates are determined by your current age.

All AARP policies come with an accelerated benefit, which allows you to access some of the death benefit while still alive if you receive a terminal illness diagnosis with less than 24 months to live.

If you’re confined to a nursing home for over 180 consecutive days due a terminal illness, the waiver of premium for nursing home stays will kick in. This means premiums are waived until you’re no longer confined or pass away.

Pros and Cons of AARP Final Expense Insurance for Seniors

AARP permanent life insurance policies and AARP term life insurance policies have their pros and cons. Consider these before buying a policy.

Pros

- Term to permanent exchange option

- Backed by New York Life

- Online quote and application

- No medical exam

- Term and whole life options

Cons

- More expensive than other options

- Few rider benefits

- Must be 80 or younger to apply

- Tough qualifications

- Must be an AARP member

- Term rates increase every 5 years

AARP Final Expense Insurance

Most seniors looking for life insurance coverage are looking for it to cover final expenses and burial costs. AARP Final expense life insurance offers lifetime coverage that never decreases and premiums that never increase.

If you die without life insurance, then your loved ones are on the hook for your medical bills and funeral costs, unless you have savings to pay for them. With so many hardworking, God fearing Americans struggling financially, especially seniors, the last thing you probably want to do is make your family or friends pay for your final expenses.

So, maybe you’ve been thinking about buying final expense life insurance for seniors, often called funeral insurance.

AARP Funeral Insurance

The AARP Funeral Life Insurance Program offers funeral life insurance coverage for seniors between the ages of 50 and 80. Your spouse or partner is also eligible for coverage at age 45. If you live in New York, you and your spouse can apply if you are between 50 and 75.

AARP has two options, simplified issue or guaranteed issue. Simplified issue is cheaper and doesn’t require a medical exam, but you have to answer health questions to get approved. If you answer “yes” to any of these questions, you won’t be approved for simplified issue life insurance through AARP:

- In the last 2 years, have you been diagnosed, treated, or medicated for any immune disorder, heart complications, cancer, lung disease, stroke, AIDS, or kidney disease?

- In the last 2 years, have you been hospitalized or received skilled nursing care for any illness?

- In the last 3 months, have been to the doctor, had tests completed, or received treatment for any illness or ailment?

Many people have pre-existing conditions, so that last one is tough for a lot of seniors to answer no to. If you can’t, then the AARP Funeral Insurance Program has another, more expensive option called AARP Level Benefit Term Life.

AARP Burial Insurance Plans

Burial insurance is a guaranteed life insurance policy for seniors. There are no health questions to answer or medical exam to complete. You are guaranteed to be approved, as long as you meet the age requirements.

If you can qualify for the AARP life insurance simplified issue policy, you can get up to $50,000 in coverage. If not, then the guaranteed issue life insurance policy for seniors is available up to $25,000. It’s not a lot of coverage, but it’s enough to pay for a funeral with viewing and services, or cremation, if you prefer.

AARP Life Insurance For Seniors

When you buy AARP life insurance for seniors and you die during the first two years, your beneficiary gets a limited death benefit, which is the amount you paid in premium since you took out the policy, plus 10% interest.

The only way your beneficiary gets the full death benefit in the first two years is if you die by accident.

AARP Senior Life Insurance

When you buy life insurance, you expect the company to pay your death benefit to your beneficiary quickly after you die. Unfortunately for many AARP life insurance policyholders, that doesn’t seem to be the case.

Customers and beneficiaries have submitted AARP life insurance reviews that paint a questionable picture about their senior life insurance products.

While some only talk about not getting approved or having their down payment mysteriously returned months after not hearing whether they were approved or denied, others talk about being overcharged for payments or their policy canceled without their knowledge.

Save Money and Headaches By Avoiding AARP Level Benefit Term Life Insurance From New York Life

We don’t think that’s right, and we’re here to help you. At Final Expense Direct, we only work with the best top rated final expense life insurance companies.

Note: According to a Penn State University study, 99 percent of all term policies never pay out a claim. Contact us to insure your family receives your life insurance money.

AARP Life Insurance Costs

So, how much does an AARP life insurance plan cost seniors? If you aren’t already an AARP member, you have to become one to even be considered. If you do an automatic renewal with a credit or debit card, it’s $12 a year, or $16 without it. Not too expensive, but still an extra cost if you aren’t already a member.

With AARP, a 50-year-old male would pay $33.18 per month for life insurance. Now, let’s compare that same life insurance policy with Mutual of Omaha. The same man would pay $29.16 a month.

That $4.02 savings a month doesn’t really sound like much. But, it’s $48.24 over a year, and $482.40 after 10 years.

As you can see, the premiums for Mutual of Omaha are generally lower than the premiums for AARP. This is likely due to the fact that Mutual of Omaha is a larger company with a more competitive pricing structure. However, it is important to note that these are just estimates and the actual premiums you may pay will depend on your individual circumstances.

Contact Final Expense Direct today to get your personal final expense insurance quote. 1-877-674-0236 Get Your Free Quote Today!

For a senior with a fixed income, those savings can mean a lot.

Not a great deal.

Mutual of Omaha is just one of the life insurance companies we work with here at Final Expense Direct. We only work with the top final expense life insurance companies offering competitive rates for seniors like you.

Call us today at Final Expense Direct, where we can usually get you a better policy with a full death benefit from day 1. Our carriers can also offer more coverage and you can get a better rate than AARP’s “group pricing” — and you still won’t have to take a medical exam!

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Conclusion - NewYorkLife AARP Insurance

The NewYorkLife AARP Insurance Program offered through New York Life sounds like a great deal. But for seniors looking for a great deal on life insurance policies, it’s anything but.

AARP life insurance for seniors is expensive, restrictive, and doesn’t offer much coverage.

Buyer beware of AARP senior life insurance! If you’re in the market for affordable final expense life insurance, call us at Final Expense Direct — this type of life insurance is all we do! Let us offer you and your family peace of mind, and guaranteed coverage when you need it the most.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?