Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 19 Apr 2024

Many working Americans get life insurance through their job because it’s affordable and the premiums come right out of their paycheck. They figure they’re covered, and they don’t have to think about life insurance anymore.

But then, things change at work. Your benefits get cut, and now you’re scrambling to get coverage on your own.

Or, worse yet, you’re finally able to retire after spending all those years working. That’s when you find out something that surprises you: the life insurance you paid for all these years can’t go with you.

So, now you’re retired — or close to it — and you don’t have any life insurance.

Getting life insurance as a senior can be more difficult than when you’re young and healthy. It’s more expensive, and you’ve been working hard, so your health may not be the best.

The good news is, you probably have a lot less expenses now, and may only need enough coverage to pay for your end-of-life costs. This type of coverage is often called final expense insurance and is usually unique to seniors.

Americo is one of many life insurers that offers this type of permanent life insurance? Is it the right choice for your situation? Let’s see what Americo offers and if it’s the best option.

Americo Final Expense Insurance

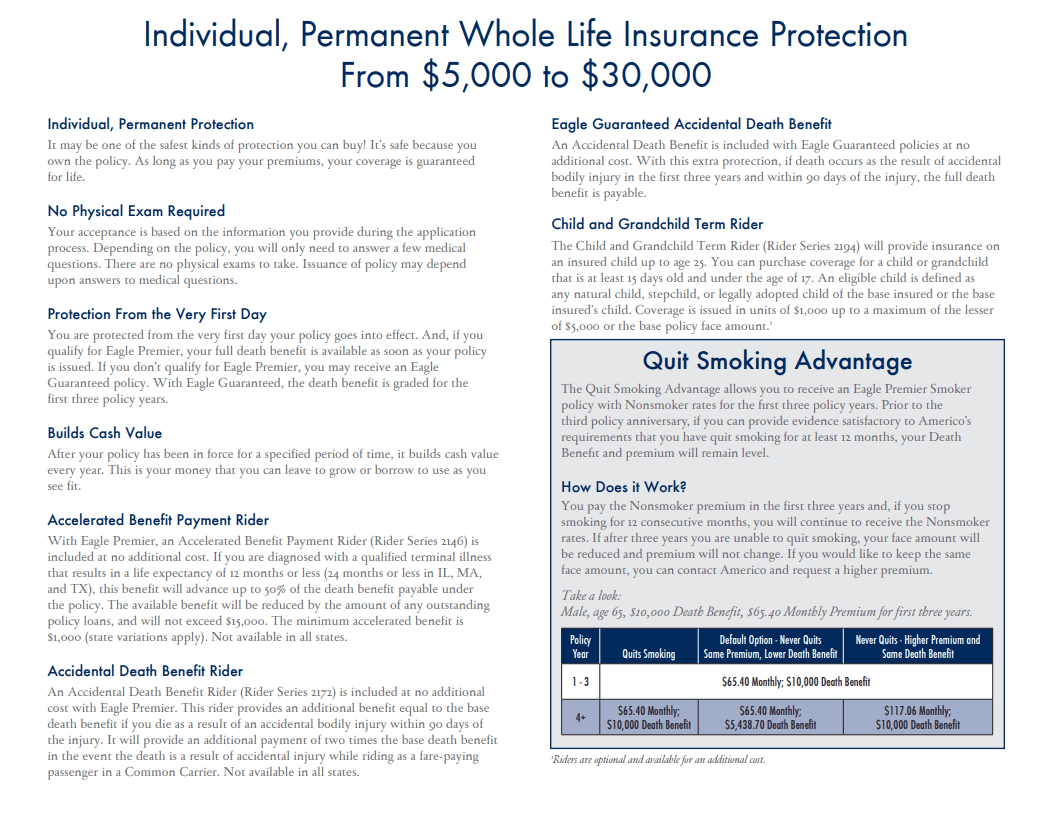

Americo offers final expense insurance, which is lifelong life insurance coverage. Premiums never increase once you’ve locked in your policy, and your death benefit — that’s the amount your beneficiary gets paid once you pass — stays the same.

You can get a quote online or speak directly with an Americo agent.

Their final expense program is run under the Eagle Premier Series program which includes everything they target for Seniors.

You can get permanent final expense insurance up to $30,000, but Americo determines the maximum you can get depending on your age. A 60-year-old may only be eligible for $15,000, which might not be enough to cover your final expenses.

Americo Burial Insurance

A lot of companies call final expense insurance burial insurance. They both mean the same thing. If you don’t already have life insurance and don’t think your family can pay for your burial — or don’t want to burden them with the expense — buying burial insurance is a great idea.

Americo Funeral Insurance

Funeral insurance is also another name for final expense life insurance. Funerals can be expensive, with just a basic funeral with viewing costing an average of $8,800. Add on a church service, headstone, cemetery plot, travel to the cemetery, and other services. You’re easily looking at over $10,000.

Now, you could get funeral insurance through the funeral home. The problem with doing that is, the funeral home works with just one life insurer to offer coverage based on the cost of your preferred funeral arrangements. It’s usually a company that has high rates, but offers the best incentives to the funeral home.

Funeral Home Prepaid Plan

They will also try to offer a prepaid funeral plan. It’s where you pay them in advance for your funeral arrangements. It sounds like a great deal, being able to shoulder the burden now so your family doesn’t have to later on.

But what they don’t tell you is that, just like everything else in this great country, inflation increases the cost of funeral goods and services. So what costs $10,000 now could cost $12,000 or more when you die.

And who will be expected to pay the difference? Your family, of course!

That’s why, if you don’t have life insurance and don’t want your family to pay for your funeral, you should buy final expense life insurance.

Americo Life Insurance For Seniors

Final expense insurance is often called life insurance for seniors, because it usually has a minimum age limit to be eligible. With Americo and a lot of other carriers, you can get final expense insurance as young as 50. So, if you find yourself without life insurance at work or just never got around to getting coverage, now may be the best time to get senior life insurance.

Americo Senior Life Insurance

The younger you are, the cheaper it is to buy senior life insurance. Your age is one of the biggest factors that determine how much you pay.

Your current health status also makes a big difference. If you buy senior life insurance from Americo, you’ll have to answer some health questions before they’ll approve you.

When you get a quote online, there’s just one health question to get a price.

Have you ever been given medical advice, been prescribed medicine, or diagnosed, treated, or tested positive for any of these health conditions:

- AIDS, ARC or HIV

- Alcohol or drug abuse

- Cancer

- COPD or emphysema

- Diabetes

- Heart issues

- Liver dysfunction

- Mental health issues

- Organ or tissue transplant

If you answer no, Americo will probably approve you. But if you have, then you have to speak with an agent who will probably deny you for coverage.

If you can’t answer no, don’t worry, because we have a solution for you.

Americo Life Insurance Costs

Now, what you’ve really been waiting for: how much will senior final expense life insurance with Americo cost?

If you’re a 50-year-old man, you can expect to pay about $40 per month with Americo. Women pay less because they have a longer life expectancy, so for the same coverage, a woman would only pay $34.

Now, if you wait until you’re 60 to buy final expense insurance, the rate increases to $52 a month, or $41 for a woman.

Let’s compare that to one of our preferred vendors, Mutual of Omaha. The same 50-year-olds would pay just $29 for a man and $25 for a female. And if you buy final expense insurance at 60, rates are only $43 and $33, respectively.

This is why it’s so important to shop before you buy life insurance. Each company sets its own rates, so you could pay more for the same policy and not even know it.

At Final Expense Direct, we work with a long list of the best final expense life insurers in the nation. We do all the shopping for you, so you don’t have to.

You simply pick up the phone, get in direct contact with one of our agents — you never have to deal with an automated system here — and we’ll help you choose the best plan at the cheapest price.

You won’t get that with Americo, because their agents only work for them.

Americo Life Insurance Costs with Pre-Existing Condition

But what if you have a pre-existing condition that will probably get you denied with Americo? We work with carriers that don’t ask any health questions at all. As long as you meet the age minimum, you’re approved.

For the same 50-year-olds, AIG offers a guaranteed issue final expense policy for $52 or $36 each month. If you’re 60, then you’ll pay $63 or $43 monthly.

Just a few more dollars a month, and you can get approved no matter what your health concerns are. If you’re a senior and need life insurance, just one phone call to Final Expense Direct can get you approved before you hang up the phone.

Yes, we really do make it that easy!

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Conclusion

Buying life insurance as a senior can be tricky, especially if you have some health issues.

Though Americo might deny you coverage, you don’t have to worry about that at Final Expense Direct.

We can get you covered, even if it costs you a few extra dollars a month for guaranteed coverage.

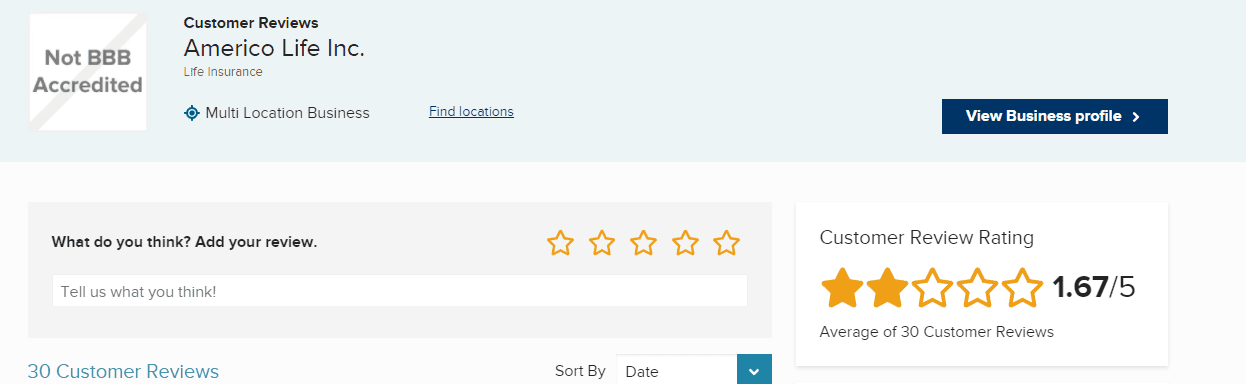

Americo BBB Reviews are mostly negative and complain of policy cancellations and failure to return premiums.

We also work with companies that don’t have as many health conditions that can get you denied, so we might get you coverage cheaper than Americo.

Call us today at Final Expense Direct to find out. We can offer you and your family peace of mind and ease the financial burden, so they can focus on grieving you when your time comes.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?