Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 18 Apr 2024

Amica Mutual Insurance Company, headquartered in Lincoln, Rhode Island, has been offering insurance since 1907. It offers several types of insurance policies, including auto, home, flood, marine, motorcycle, umbrella, and small business.

You can also get life insurance through Amica. But is Amica a good insurance company?

You’ll find out in this Amica insurance review, where we discuss their life insurance products to help you decide if it's the right company for you.

Amica Life Insurance Products

Amica offers two types of life insurance products: term and whole life.

Most who apply for Amica life insurance will have to complete a medical exam to buy a policy. Those who are in the best underwriting classes – the healthiest applicants – can skip the medical exam.

If you’re a healthy senior, you might qualify for Amica life insurance with no medical exam. But for most God fearing American seniors, expect to complete an exam if you want to get life insurance through Amica.

Amica Term Life Insurance

Adults can apply for Amica’s level term life insurance policy through an Amica agent, although you can get a quote online. Premiums are level and won’t change for the length of the term policy, which can be 10, 15, 20, 25, or 30 years of coverage.

Amica term life insurance starts at $100,000 in coverage, but you can get up to $5 million in coverage. This policy has a conversion option, which means you can convert it to a permanent policy no matter your health status. How long you have to convert the policy after it's in force depends on the length of the term.

The Amica term life insurance policy comes with a terminal illness rider. This rider allows you to access up to 50% of the death benefit while you’re still alive if you’ve been diagnosed with a terminal illness and have less than 12 months to live. If you exercise the rider, the amount you receive will lower the death benefit amount your beneficiary gets when you pass away.

While buying term life insurance is usually the best and cheapest way to cover temporary needs, like paying off debts and replacing income as the breadwinner of the family, Amica may not be the best choice for everyone, especially if you want more rider options.

Amica Whole Life Insurance

Amica offers one type of whole life insurance with several payment options. Its whole life insurance policy starts as low as $25,000 in coverage, going up to $1 million or more.

Like its term life policy, Amica’s whole life plan also comes with the terminal illness rider. However, it comes with the additional benefit of cash value, which acts like a savings account built into the policy. After all policy fees and costs are paid, the rest of the premium goes towards the cash value, which can be used while you’re alive to borrow against or pay premiums.

Amica has several payment plan options for its whole life insurance policy:

- Whole Life 20

- Whole Life 65

- Whole Life 100

Whole Life 20

The Whole Life 20 plan is the most expensive because you only pay into the policy for 20 years. After that, it's guaranteed for life, without you needing to pay into the policy again. Seniors up to age 80 can apply.

With the short payment period, this is a great policy to buy for young children and grandchildren. It gives them guaranteed life insurance that’s paid up, so they never have to worry about their health, preventing them from being approved for life insurance later on.

Whole Life 65

Payments for the Whole Life 65 plan are over when the insured turns 65, but you can only buy it if you’re under 50-years-old. Once you turn 65, Amica guarantees the policy until death. This plan is cheaper than the Whole Life 20 plan, depending on your age when Amica issues the policy.

This limited pay option is best for young adults or those nearing retirement because you won’t have to pay any payments in retirement unless you retire before you turn 65.

Whole Life 100

The Whole Life 100 plan is the most common payment type for whole life insurance. This policy is the cheapest because you’ll pay on it until you reach age 100, or die, whichever comes first. With such a long payment period, this whole life policy is the cheapest option Amica offers.

If you want permanent life insurance without a huge price tag, a whole life policy paid to age 100 is usually going to be your best bet.

Does Amica Offer Life Insurance For Seniors?

Yes, Amica does offer life insurance for seniors up to age 80. You can get term or whole life insurance, but be prepared to take a medical exam. If you’re not healthy, Amica will probably deny you, or get a more expensive rate than you would with other carriers.

If you’re interested in term life insurance, you can get a quote online by providing your:

- Coverage amount

- Level of health

- Tobacco usage

- Sex

- Date of birth

- Height

- Weight

- Legal name

- Address

- Phone number

- Email address

If you like the rate, you can apply online, though online quotes and applications may not be available in all states.

If whole life insurance is a better fit for your coverage needs, you’ll have to speak with an Amica agent to get a quote and apply for coverage.

Amica Life Insurance Final Expense Insurance

Although Amica offers whole life insurance, it’s not the same as final expense insurance. When you buy final expense insurance, you rarely have to take a medical exam. Depending on the company and policy, you’ll have to answer some health questions to complete the application.

Seniors up to age 80 can apply for Amica life insurance products. If you want the Amica Whole Life 65 plan, you have to be under 50 to qualify.

To qualify for coverage without a medical exam, you have to fall into Amica’s preferred platinum health underwriting class and meet these criteria:

- Have an average current blood pressure reading of 130/80 if you’re 45 and under, or 135/85 if you’re over 45.

- Only take a single medication to control high blood pressure if you’re over 40, if applicable

- Have a total cholesterol level under 250 and a cholesterol/HDL ratio below 4.5.

- For those applying under 65, there can be no family history (parent or sibling) of death from heart attack, stroke, cancer, or coronary artery disease before age 60.

If you don’t meet these criteria, you’ll probably have to take a medical exam for Amica life insurance.

Amica Life Insurance Burial Insurance

Although Amica doesn’t offer burial insurance, you can use whole life insurance as burial insurance. Typically, final expense insurance and burial insurance mean the same thing: a type of whole life insurance with no medical exam and low coverage amounts often used by seniors to pay for funeral costs and other end-of-life expenses.

Amica’s whole life insurance starts at $25,000, which is usually the maximum you can get with a final expense life insurance policy. If you need more coverage, a company like Amica may be the best choice. The Baltimore Life Companies is another option, offering coverage up to $150,000 for burial insurance.

Amica Life Insurance Funeral Insurance

You can set aside a portion of Amica life insurance to use as funeral insurance. If you buy term life insurance, you’ll only have funeral insurance until the term expires. But if you buy Amica whole life insurance, then you’ll have a guaranteed death benefit to pay for funeral expenses.

Although young adults may feel like they’ll live forever, seniors know that the Good Lord could call them home at any time. And with the median cost of a funeral continuing to rise with inflation, even a basic funeral with burial and viewing could cost over $9,000.

If you don’t have these funds set aside and your loved ones won’t be able to pay, funeral insurance is a great way to remove the burden from your family. Instead of having to save money for your funeral, you can pay your insurance premiums, knowing when the time comes, your beneficiary can use the death benefit to pay for your funeral and other final expenses.

Amica Life Insurance Costs

Amica life insurance costs depend on your age, health status, gender, tobacco usage, policy type, and payment duration if you choose whole life insurance.

You’ll always pay less when you buy term life insurance because coverage is only available for a certain number of years. The longer the term, the more you’ll pay for coverage. And after you've paid into the policy for all those years, if you’re still alive when the term expires, your policy cancels and you and your beneficiary receive nothing.

While term is a good choice for temporary needs, it’s not the best choice for permanent needs, like paying for a funeral.

If you have permanent needs, like most God fearing American seniors, you’re better off with final expense insurance. No matter how old you get, you’ll have peace of mind knowing that when the Good Lord calls you home, your loved ones won’t have to face the burden of paying those expenses because you took care of them while you were still alive.

You can check out rates for final expense insurance by age:

And by coverage amount:

Amica Insurance Reviews and Ratings

Before you buy life insurance, you should consider reviews and ratings to compare one company to the next. You can gauge a company’s consumer satisfaction by how it treats its employees, customers and claimants reviews, and its third-party rankings.

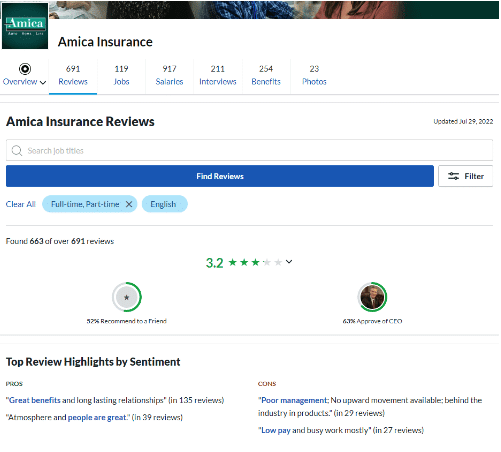

Amica Insurance Reviews and Ratings: Glassdoor

Glassdoor is a website current and past employees can use to review the company. Amica insurance reviews on Glassdoor show 52% of employees would recommend it to a friend and 63% approve of the CEO.

With almost 700 reviews, Amica has earned 3.2 out of 5 stars from its employees. Although Amica offers a great benefits package, poor management and low pay reduce the insurer down to an average overall rating.

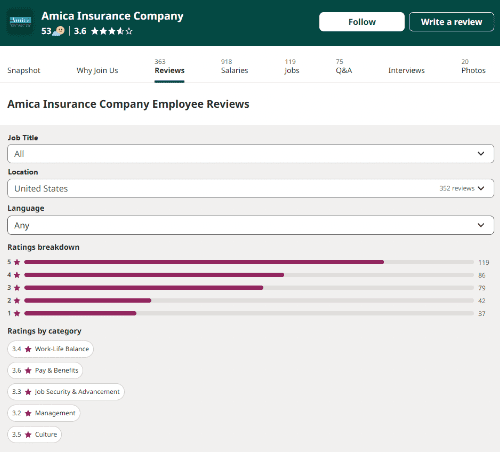

Amica Insurance Reviews and Ratings: Indeed

Indeed isn’t just a place to find jobs, current and former employees can also review the company to help prospective employees decide if it's the right fit. Amica gets a slightly higher rating on Indeed, earning 3.6 out of 5 stars after 363 reviews.

Reviewers show similar pros and cons on Indeed as Glassdoor. While the benefits are nice, work/life balance and pay make the company a not-so-great one to work for.

Amica Insurance Reviews and Ratings: BBB

Amica has been accredited by the Better Business Bureau since 1957 and has earned an A+ rating with the BBB for responsiveness, the highest rating available. It has 95 customer complaints filed in the last 3 years, with 45 closed in the last year.

After 38 customer reviews, Amica earns 1.13 out of 5 stars with the BBB. Most reviews are about its auto and life policies, concerning poor claims and customer service response, billing issues, and coverage problems.

Amica Insurance Reviews and Ratings: Trustpilot

Trustpilot is a consumer website customers and claimants can use to review companies like Amica. After 1,400 reviews, Amica earns an excellent rating with Trustpilot, with 4.6 out of 5 stars.

Eighty percent give Amica an excellent rating, while 11% give it a rating of average or worse. The most notable bad reviews show frustration with lack of responsiveness, inability to insure homes, and poor claims experience for auto and home policies.

Amica Insurance Reviews and Ratings: YouGov

YouGov is a global online community where people can learn more about a company’s beliefs, behaviors, and branding. Amica is ranked 40th for insurance brands, with 54% of respondents having heard of Amica and 23% liking the company. Six percent dislike Amica, while 25% remain neutral. Amica is most popular with millennials and men, according to YouGov rating data.

Amica AM Best Rating

A company’s financial strength shows how easily it can handle financial obligations, including paying out life insurance claims. Amica’s financial strength rating is superior, earning an A+ rating with AM Best. It has regularly earned an A+ rating for years and has over $2 billion in assets.

Amica Life Insurance NAIC Complaint Index

The National Association of Insurance Commissioners issues an annual complaint index score for each insurer. It’s based on the number of complaints each carrier receives compared to its competitors. With an NAIC complaint index average of 1.00, Amica’s 0.53 complaint index shows the life insurer receives half the complaints expected for the industry and compared to other life carriers.

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Conclusion

Amica is a solid insurance company with a good reputation, but it may not be the best fit for everyone. It doesn’t offer final expense insurance, so most seniors will have to complete a medical exam to find out if they'll be approved for life insurance, which also determines the cost. If you have health issues or don’t need much coverage, there may be a better option available. Contact our agents at Final Expense Direct to learn which final expense companies best fit your needs. You can get a quote and approval for coverage in the same phone call since you don’t have to worry about a medical exam with our final expense companies.

Frequently Asked Questions

Is Amica a Reputable Company?

Yes, Amica is a reputable company with high financial stability ratings, which means it can pay claims with ease. However, customer reviews across multiple platforms show that the claims process for auto and home can be frustrating, with some not finding out they don’t have the right coverage in place until it's too late.

Does Amica Pay Claims?

Yes, Amica does pay claims, though the process looks different, depending on your policy type. With an A+ financial strength rating, Amica has the assets to pay out claims, even substantial claims for life insurance.

Does Amica Use Agents?

No, Amica does not use agents to sell and service its products. It uses in-house Amica representatives, which you can contact by phone, email, or U.S. mail.

How Do I File a Death Claim With Amica?

The policy beneficiary can file a death claim with Amica by reporting the claim online, or by calling Amica at 1-800-234-5433, extension 89079.

What Information is Needed to File a Death Claim With Amica?

The following information is needed to file a death claim with Amica: a certified copy of the insured’s death certification. To complete the claim, you’ll also need to know the cause and manner of death. Amica may also require more information for medical history, including doctors names and details about medical treatment.

Who is Amica Owned By?

As a mutual insurance company, Amica is owned by its policyholders. Its policies are also issued by Amica, not another company. Certain Amica policies are eligible to earn dividends, which is a return to the policyholders after all expenses are paid and there is a surplus of premiums paid.

Does Amica Offer A Free Look Period?

Yes, Amica does offer a free look period on life insurance policies. Once the policy is issued, you have at least 10 days to decide if you want to keep the policy. In some states, it might be longer. If you decide you no longer want the policy, you can cancel it and get a full refund of any premiums paid. If you cancel outside the free look period, you may incur surrender charges on a whole life policy.

How Do I Cancel My Amica Life Insurance Policy?

If you want to cancel your Amica life insurance policy, you’ll have to call them at 1-800-234-5433, extension 89075. Once you speak with a representative, you’ll have to sign a form confirming the policy cancellation. Once the life insurance policy is canceled, you don’t have the option to reinstate the policy, you’ll have to apply for a new policy and go through underwriting again.

How Long Do You Have to File a Life Insurance Claim With Amica?

Amica doesn’t impose a time limit when you file a life insurance claim, so you have as long as you need. However, the sooner you file the life insurance claim with Amica, the sooner you can get the death benefit payout.

Can You Get Life Insurance With Amica if You Have Cancer?

If you currently have cancer, you probably can’t get life insurance with Amica. But if you’re in remission, the type of cancer, stage, treatment protocol, and time since you went into remission will be taken into account to determine eligibility for Amica life insurance.

Does Life Insurance From Amica Cover a Drug Overdose?

Yes, life insurance from Amica should cover a drug overdose, as long as you’ve had the policy in force for over 2 years. Drug overdoses are typically treated like an accident or a heart attack. If the policy has been in force for less than 2 years, the company may review the application to make sure the application didn’t lie and may invoke the suicide clause if the overdose cause of death was suicide. In either of these cases, Amica may decline the claim.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?