Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 20 Apr 2024

Many seniors are under the misconception that if they don’t already have life insurance, it’s too late. Whether it’s because you think it’s too expensive or you won’t qualify for your health, we’re here to tell you that’s not the case.

While not all seniors need life insurance, many can’t afford to pay for their funerals and end-of-life expenses. If that’s you, then you need life insurance.

Depending on your age, you may not be eligible for term life insurance. While it’s cheap, it’s temporary, so you’re likely to outlive the policy.

Why throw away money on temporary life insurance when you can get permanent coverage for a few dollars more per month?

If you’re a senior who needs life insurance, you probably don’t need much. In this situation, the most cost-effective type of life insurance is final expense life insurance.

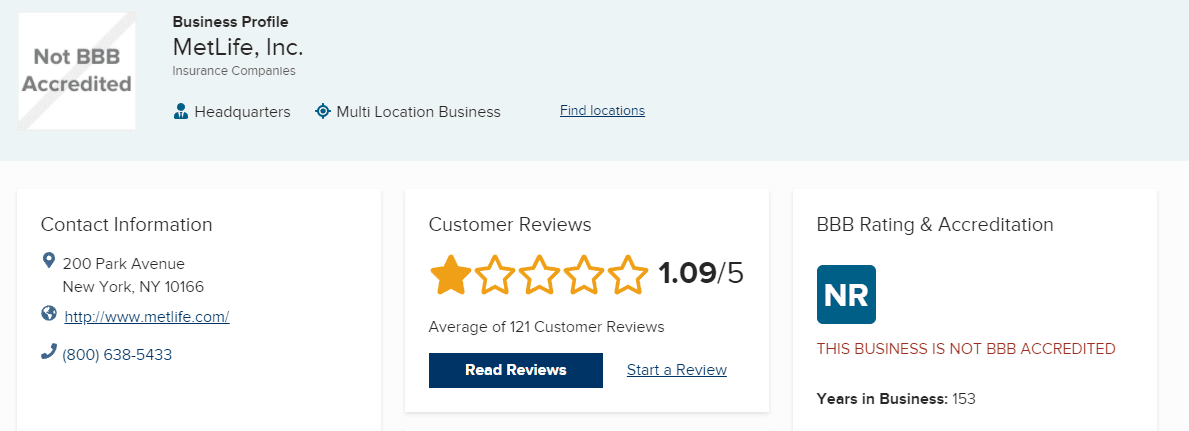

MetLife is one of the oldest life insurers in the industry. They’ve been in business for over 150 years. You may have even had employee benefits through MetLife at your job.

While they’ve been around for a long time, MetLife isn’t always the best choice for everyone. Here’s what you need to know to decide if MetLife is right for you.

MetLife Final Expense Insurance

MetLife offers guaranteed issue final expense insurance. Final expense life insurance is a type of whole life insurance meant specifically for seniors.

This is permanent coverage meant to last the rest of your life. Some features of MetLife’s final expense insurance are:

- Guaranteed acceptance

- Builds cash value

- Rates never increase

- Death benefit never decreases

MetLife offers their final expense insurance to Americans as young as 45, up to age 75. As long as you continue to pay your premiums on time, they cannot cancel the policy for any reason.

With MetLife, you can get as little as $2,500 in coverage and as much as $50,000.

MetLife Burial Insurance

Burial insurance is another term used for final expense insurance because seniors typically buy it to pay for their burial costs.

If you want your final expense life insurance to cover more, like your final debts or leaving a small inheritance for your kids or grandkids, then you should buy more coverage.

When you buy burial insurance or a final expense life insurance policy, you get to pick your beneficiary. You can name your spouse, children, grandchildren, or a combination. You can even name a dear friend who you trust to honor your last wishes.

When the time comes, the insurance company, whether it’s MetLife or another company, will pay your beneficiary the death benefit.

MetLife Life Insurance For Seniors

Life insurance for seniors sounds complicated, but it’s actually a simple policy to understand. You have two options to choose from, and the right choice depends on your health.

MetLife Senior Life Insurance - Simplified Issue

If you are relatively healthy with just a few minor health concerns, you can usually qualify for simplified issue senior life insurance.

This policy asks a few health questions, and you’ll be approved if you can answer no to them all. The type and number of questions vary by the company. Simplified issue senior life insurance is cheaper than the other option, because your health is used to determine your eligibility.

Most often, if you have any of the following pre-existing conditions — health issues that were present before you applied for life insurance — you won’t be approved for simplified issue.

Those conditions are:

- Alzheimer’s or dementia

- Diabetes

- Cancer

- AIDS or HIV

- Heart disease

- COPD or emphysema

- Stroke

- Liver dysfunction

- High blood pressure

- Organ or tissue transplant

- High cholesterol

If you have any of these health problems, it doesn’t mean you’re guaranteed to be denied, but it increases your chances. If you smoke or are overweight with another health condition, it also increases your chances of being denied.

If you are, don’t worry, because you have another option available.

MetLife Senior Life Insurance - Guaranteed Acceptance

Like the name suggests, guaranteed acceptance senior life insurance means you’re guaranteed to be approved. There are no health questions or medical exam to complete for a guaranteed issue policy.

This is the type of final expense life insurance MetLife offers. So, if you have a lot of health problems or get turned down for simplified issue, you can get approved for guaranteed acceptance life insurance.

One thing to note with a guaranteed issue whole life insurance policy. MetLife and many other carriers have what’s called a graded death benefit on these policies.

If you die for any reason other than an accident in the first two years, your beneficiary will only receive the premiums paid plus interest, which is at least 10%. If you die for any reason after two years, they will get the full death benefit.

MetLife Funeral Insurance

If you’ve already thought about your funeral costs, you may have reached out to a funeral home already, or have a preferred one. Knowing how much your funeral and viewing will cost, with all the extras like a cemetery plot, gravestone, and casket, you’ll have a good idea of how much final expense insurance you need.

But the funeral home might try to sell you something called funeral insurance. It’s just another name for final expense insurance, but it could be much more expensive than getting it on your own.

They’ll only offer one option, which is guaranteed acceptance, with one carrier. All companies set their own rates, which means you could pay a lot more for the same policy with one company compared to another.

Prepaid Funeral Plan

Funeral homes might also offer a prepaid funeral plan. This is where you pick out your funeral details, they’ll tally up the cost, and you set up a payment plan to pay it off over time.

Sounds like a great deal, right?

Well, what they don’t tell you is that prices will go up thanks to inflation. If the funeral you want costs $10,000 now but $13,000 when you die, your family is on the hook to pay for the rest, or they have to remove some goods or services you picked out.

MetLife Life Insurance Costs

Now, how much does MetLife final expense insurance cost? How much you pay depends on your age and coverage amount.

With Metlife, a 60-year-old man would pay $75 a month for a $10,000 policy. But what if you could get it cheaper with another company?

At Final Expense Direct, we work with a long list of some of the top final expense companies in America, like AIG. That same policy would cost you just $63 a month, saving you $124 a year.

At 70, the cost difference is even bigger. MetLife will charge you $127 a month while AIG will only charge you $98. That’s a savings of $29 a month, or $348 a year.

That’s why it makes sense to work with an independent agency like Final Expense Direct. We can help you find the right policy for your age, needs, and health. And we’ll also make sure it’s the cheapest option with the right coverage.

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Conclusion

Most seniors only need a small amount of life insurance, so it makes sense to buy final expense insurance.

You’ll get to keep the policy for life and lock in the same rates forever.

Though MetLife has a long history in the life insurance industry, they can’t always offer the cheapest rates for guaranteed issue final expense life insurance for seniors.

If you work with Final Expense Direct, we’ll get you the best price and coverage so you have peace of mind and can keep some of your hard earned money to use elsewhere.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?