Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 24 Apr 2024

Have you heard about National Family Assurance Corporation?

This company is a broker offering life, health, medicare, auto, and home insurance. National Family offers both term and final expense life insurance.

Today, we’re going to focus on their final expense life insurance for seniors plans to see if they’re worth it for God fearing Americans like yourself.

National Family Assurance Life Final Expense Insurance

National Family Assurance offers final expense insurance to seniors aged 50 to 85. As with most final expense policies, there is no medical exam to get approved for coverage.

When you first go to the website, it’s just a single page where you click on the type of insurance you want. If you select life insurance, it immediately puts you into a quote screen for you to enter your information to get quotes for coverage. The only other option is to call them to speak with a licensed agent.

There’s nothing on the website about the companies National Family Assurance partners with, the coverage amounts, or anything else about the products they offer.

When you scroll to the bottom of the page, you find out that National Family Assurance is just a website that is owned and operated by Assurance IQ, LLC. This company is the real licensed insurance agency.

Really, they’re a broker, just like Final Expense Direct. But more about that later.

Going to Assurance IQ’s website, you find out more details about the policy types, but still nothing about the companies they partner with that actually provide the insurance policies.

Keep scrolling and you’ll find out Assurance IQ, LLC is actually a subsidiary of Prudential Financial. Now we’re getting somewhere, but we still don’t know what insurance companies you’ll potentially be getting a policy through.

National Family Assurance Life Burial Insurance

National Family Assurance offers up to $30,000 in burial insurance, which is final expense life insurance for seniors.

They offer “top life insurance plans at affordable rates.” Or do they?

If you click through the quote screens, entering your information along the way, you’ll have to answer questions about:

- Your name

- Date of birth

- Gender

- Marital status

- Smoking status

- If you have children

- What you’re looking for in life insurance

- Your height and weight

- Current employment status

- Your ZIP code

- If you’ve been treated or prescribed medication for any of the following in the past 5 years:

- Anxiety, depression, or bipolar

- Cancer

- Chronic pain

- Diabetes

- Heart or circulatory disorder

- Respiratory disorder

- Any other medical condition not named

There’s a disclaimer on the last screen where you enter your phone number “by clicking on the View My Results Button, I agree to the consents below the button.” By clicking the button, you’re consenting to be contacted and to sharing your information with Prudential companies and affiliates for marketing purposes.

And, you will definitely be contacted!

National Family Assurance Life Insurance for Seniors

After clicking View My Results, you’ll get a list of carriers for National Family Assurance life insurance for seniors based on the information you entered on the quote screens.

Most of the options aren’t even insurance companies, they’re more insurance brokers offering coverage through a network of insurers. Your information is prefilled and you can then click to get quotes, which just keeps sending you to more insurance brokers.

And the worse part? Your phone will start ringing off the hook!

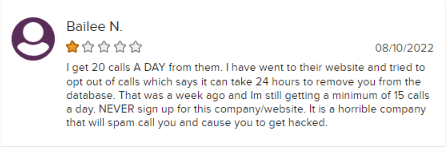

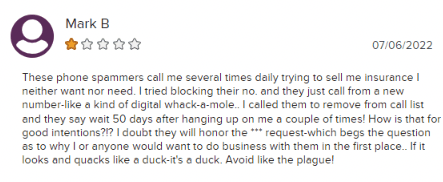

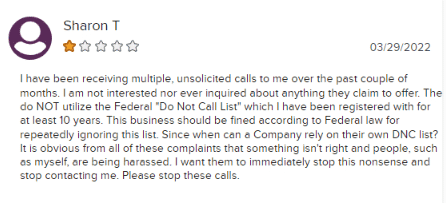

But don’t take our word for it. Just check the Better Business Bureau profile for National Family Assurance. They might have a B rating – not the A+ you’re told they have – but their customer reviews score is a 1.04 out of 5 stars with 52 customer reviews.

Their Facebook page isn’t much better. After 43 reviews, National Family Assurance has 1.3 out of 5 stars.

Assurance IQ, the wholly owned subsidiary of Prudential, doesn’t fare much better. Assurance has an A+ BBB rating and is accredited, but after 120 customer reviews, they receive a 1.38 out of 5 star rating.

Almost all the customer reviews complain about non-stop calls on both profiles.

National Family Assurance Life Funeral Insurance

Like National Family Assurance Life, Final Expense Direct is an insurance broker offering funeral insurance, or final expense insurance. We might even work with the same carriers, though we can’t tell because we aren’t sure which companies are affiliated with National Family Assurance or Assurance IQ.

Why work with us and not them?

Well, we have an A+ rating with the BBB and we’re also accredited. We’ve had 68 customer reviews submitted and our customer review rating is 4.74 out of 5 stars.

We also make it known on our website which final expense insurance companies we partner with. We also offer a ton of resources on our website to help you make an informed decision on your life insurance plan.

You can get actual quotes from us directly online after inputting your information, or call us to get them, if you prefer. You can also submit your application online or call to complete it with a licensed agent.

Most important of all, though, we don’t sell your phone number and we won’t inundate you with phone calls. We don’t believe in spamming people. We’ll only call you to verify your application details before we can finalize your policy.

We believe in helping God fearing Americans like yourself get quality life insurance in place for when the good Lord calls you home. We provide peace of mind to you and your loved ones so they won’t have to face financial hardships when you’re gone.

National Family Assurance Life Insurance Offerings

National Family Assurance offers three types of life insurance for seniors: term, whole life, and final expense insurance.

Term Life Insurance

At National Family Assurance, seniors can get term life insurance coverage for 10, 15, 20, or 30 years. The older you are, the less coverage time you get.

For instance, if you’re looking to buy term life insurance at 70, the most coverage you can get is for 10 years.

National Family Assurances offers up to $1 million in term life insurance coverage. But again, the older you are, the less coverage you can get.

Although rates and coverage amount are locked in for the length of the policy, term life insurance is rarely the best choice for seniors. The policy will expire, and if you outlive it, then you’re left without any life insurance coverage.

Whole Life Insurance

Unlike term life insurance, whole life insurance stays in place for your lifetime. Sure, rates are more expensive, but you don’t have to worry about dying without life insurance.

National Family Assurance claims to offer up to $1 million in whole life coverage. Of course, depending on your age and health status when you apply.

This policy has locked in rates and coverage, with the added bonus of cash value growth. You can access the cash value while still alive to use how you wish, including making premium payments.

Final Expense Insurance

The best choice for seniors is usually final expense insurance. It doesn’t require a medical exam, just health questions on the application.

If you’re in poor health, you can avoid the health questions on the application, but then you’ll only be approved for a funeral insurance plan with a 2- or 3-year waiting period. If you die a non accidental death in the first 2 or 3 years, your beneficiary will only receive 110% of the paid premiums back.

Like many final expense policies, National Family Assurance only offers up to $30,000 in coverage. For many seniors, this is enough to pay for your funeral, end-of-life costs, and potentially have a small amount left over to leave a legacy to loved ones.

National Family Assurance Life Insurance Add-Ons

One benefit of buying life insurance from National Family Assurance is the add-ons you can include. Riders can supplement your coverage, even making a family life insurance plan possible with just one policy.

These add-ons may be available on National Family Assurance life insurance:

- Child protection - provides term coverage for dependent children

- Spouse protection - provides term coverage for your spouse

- Disability income - pays certain expenses when injured at work

- Critical illness - provides living benefits if you’re diagnosed with a critical illness

- Long-term care - provides benefits to pay for long-term care expenses

- Family income benefit - pays a monthly income benefit when the insured passes away

- Accidental death benefit - increases the death benefit the beneficiary receives if the insured passes from an accidental death

National Family Assurance Customer Complaints

National Family Assurance uses questionable advertising and sales tactics that make up a majority of its customer complaints.

Customers fill out the online quote form to get rate samples, but then get unsolicited emails, mailers, and phone calls from insurance agents.

Just look at some of the recent complaints filed with the BBB.

There also isn’t an easy way to opt out through the company, making it a frustrating experience for many.

Luckily for you, we’re here to help. Here’s how to opt out of unsolicited marketing emails and phone calls from National Family Assurance:

- Contact them directly and ask to be placed on their Do Not Call list.

- Request to opt out using their Data Request Form. You can also request to not have your personal information sold using this form.

- Include your phone number in the National Do Not Call Registry.

- Do not open spam emails and delete them when they hit your inbox.

- Mark the email as spam if you cannot find an unsubscribe link at the bottom of the email.

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

National Family Assurance Life Insurance Costs

How much does National Family Assurance life insurance cost? We wish we could tell you, but we weren’t able to get quoted premiums.

You can call us or get quotes online through Final Expense Direct right now, or check out some of our sample rates based on age and coverage amount.

Final Expense Direct quotes by age:

Final Expense Direct quotes by coverage amount:

You can also learn more about the companies we partner with to offer some of the best final expense plans available:

- AIG

- Royal Neighbors of America

- Mutual of Omaha

- Great Western

- The Baltimore Life Companies

- Liberty Bankers Life

- Prosperity Life Group

- American Home Life Insurance Company

- Pioneer American Insurance Company

You can also find out why we don’t partner with these carriers:

Whether you’re a young adult or a senior, you expect to get quality life insurance you can keep for life from a company you trust. At Final Expense Direct, we work with people nationwide to get coverage at affordable rates without a medical exam.

We won’t sell your information and we definitely won’t spam you with calls. Let us provide you with peace of mind and a life insurance policy today.Conclusion

National Family Assurance Corporation is a life insurance website owned by Assurance IQ, which is a subsidiary of Prudential. The insurance broker gets your personal information, makes you jump through hoops to get a life insurance quote, and then bombards you with phone calls until you seriously consider changing your number. Call us today at Final Expense Direct to find out how we’re different. We promise we won’t spam you with phone calls.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?