Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 25 Apr 2024

Pioneer American Insurance Company is a life insurer based in Texas. While they offer term and universal life, they specialize in final expense senior whole life insurance.

Though Pioneer American isn’t a household name like AARP or Colonial Penn, we are proud to have them as one of our preferred vendors. They offer generous underwriting guidelines, which allow more seniors to get approved for affordable rates compared to competitors with brand recognition.

Keep reading to find out what Pioneer American offers and why they’re one of our preferred vendors.

Pioneer American Insurance Company Final Expense Insurance

Some seniors who don’t already have life insurance worry about getting coverage to remove the financial burden on their loved ones. For the seniors who only need a small amount of coverage to pay for a funeral or end-of-life costs, final expense insurance is often the answer.

Most companies who offer final expense insurance cap coverage at $25,000. With Pioneer American, you can get covered for up to $35,000 in life insurance. That extra $10,000 in coverage can make all the difference to pay for your final debts, so your family won’t have to worry about finding the money to pay for them.Pioneer American Life Insurance Company Policy Offerings

Pioneer American Life Insurance Company has three policy offerings seniors can choose from.

Term Life Insurance

The Pioneer American term life product offers coverage from 10 to 30 years, in amounts ranging from $25,000 to $250,000 in coverage. This simplified issue plan doesn’t have a medical exam, but there are health questions on the application.

Certain association members and groups, plus their spouses, can qualify for 10-year term plans up to age 65:

- First responders

- State-funded education institute employees

- Government employees

- Hospital employees

- Railroad employees

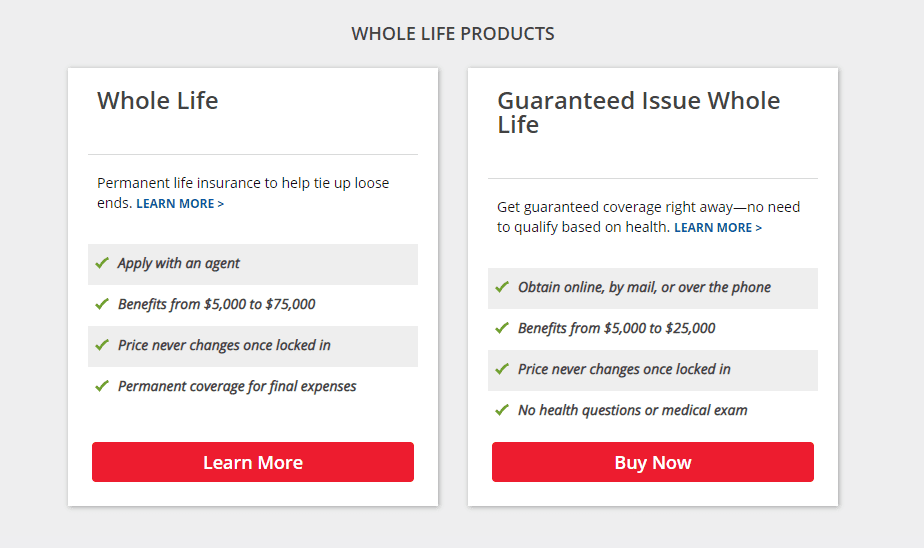

Whole Life Insurance

Pioneer American offers up to $35,000 in whole life insurance. Many seniors can qualify for an immediate death benefit, but those with serious health problems may only qualify for modified whole life with a 2-year waiting period.

This policy offers permanent coverage with a cash value savings account you can use while still alive. Coverage can start as early as 6-months-old, and seniors up to age 85 can apply.

Universal Life Insurance

Another option Pioneer American offers is universal life insurance. Seniors can qualify for up to $250,000 in universal life insurance coverage without a medical exam.

This product is like whole life, with lifetime coverage and cash value, but offers more flexibility. You can increase or decrease the death benefit or premiums as life needs change. And the simplified issue policy comes with a 15-year no-lapse policy guarantee, as long as you pay the minimum premiums.

If you’re healthy and are willing to go through the full underwriting process, Pioneer American doesn’t cap the death benefit amount, so this option may suit those with large life insurance needs, like estate planning.

The Pioneer American Life Insurance Claims Process

Pioneer American makes it easy for senior’s life insurance beneficiaries to file a claim for life insurance proceeds. The beneficiary can log in online and start the process there by completing the necessary forms.

There is also a document portal to upload documents and a live chat feature if the beneficiary has any questions. Documents can also be faxed or emailed to:

- Claims fax: 254-297-2756

- Claims email: [email protected]

The company also has claims forms online you can access, like rider and benefit claim forms and proof of death claimant statements.

If you have questions or need further help with the claims process, call Pioneer American at 800-736-7311.

Pioneer American Insurance Company Burial Insurance

Companies will sometimes refer to final expense insurance as burial insurance because that’s what seniors usually buy it for. Right now, the median cost for a funeral with burial and viewing is about $8,800. This is just the base amount, not including personal wants like a grave marker or cemetery plot.

This way, you can get the and your family won’t have to worry about coming up with the payment or crowdsourcing for funds.Pioneer American Insurance Company Life Insurance For Seniors

While most final expense insurance companies don’t require a medical exam, you will probably have to complete one for Pioneer American. But don’t get too nervous about it. Pioneer American has very generous underwriting guidelines, some of the best in the industry for life insurance for seniors.

In fact, we can usually find great coverage for veterans with Pioneer American compared to some final expense policies without a medical exam.

There are two reasons we often prefer Pioneer American to veterans:

Depression, pain meds and PTSD won’t get you denied

Those conditions — and many more — are still eligible for an immediate death benefit

One thing that can make seniors shy away from final expense insurance is the graded death benefit, or waiting period. With a graded death benefit, your beneficiary will only receive the premiums paid plus interest if you die from a non accidental death in the first two years.

That’s why it’s so important to find a company like Pioneer American, so no matter when you go to meet the good Lord, your beneficiary will receive the full death benefit.

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Pioneer American Insurance Company Senior Life Insurance

But what if you’re looking for senior life insurance and have another pre-existing condition, like:

- Bipolar

- Irregular heartbeat

- Hepatitis C

- Schizophrenia

With other companies, you could get a substandard rating, which means you’ll pay more for the same coverage than with a company like Pioneer American. But that also means you’ll have either a graded or modified death benefit.

Another great thing about Pioneer American Insurance Company is they are very lenient on height and weight, so if you’re overweight, you can still get covered. They will also approve seniors with multiple medical conditions, so if you have more than one pre-existing condition, you probably won’t get denied and can still get an immediate death benefit.

Pioneer American Insurance Company Funeral Insurance

Funerals can be expensive, especially if you want a final sendoff in style. With just a basic funeral costing almost $9,000, one that fits your desires can easily cost over $10,000. Since most seniors use final expense insurance to pay for funerals, it’s often called funeral insurance. But you have to be careful about life insurance products labeled funeral insurance — especially if they come from a funeral home.

While you should speak with your preferred funeral home to find out what your funeral could cost, it may not be in your best interest to buy funeral insurance from them. Funeral homes usually work with just one carrier, which could mean you’ll pay way more than you should for a policy.

Should You Prepay Your Funeral?

You could also prepay your funeral, which is a payment plan you set up with the funeral home to pay the full cost. However, the cost of funeral goods and services increase with inflation, which means the same funeral could cost a few thousand more dollars when you pass away.

Who pays the difference? Your loved ones do, or they have to remove goods and services to get back down to the price you paid.

Getting a senior life insurance policy on your own is your best chance at getting an affordable rate with the most coverage. At Final Expense Direct, we work with a long list of life insurance companies to help you shop for the best rates. We can usually get you approved in just one phone call, too.

Pioneer American Insurance Company Life Insurance Costs

We bet you’re wondering what life insurance costs with Pioneer American Insurance Company. We gathered some sample rates for a $10,000 final expense life insurance policy from Pioneer and comparison rates from Fidelity and Americo.

A 50-year-old male would pay about $41 a month, while a female of the same age would pay around $35. With Fidelity, the same people would pay $38 and $29, respectively. Rates with Americo would be $40 and $34 per month.

Now, let’s look at rates for 60-year-olds. For the man, life insurance costs would be $59 with Pioneer American and $52 with Fidelity and Americo. The woman would pay $47 with Pioneer American and $41 with Americo and Fidelity.

As you can see, the rates are a few dollars higher with Pioneer American. But, you aren’t guaranteed approval by either Americo or Fidelity. Which means you could get approved by Pioneer American but denied with the other two.

Pioneer American also offers a unique feature with their senior life insurance plans. If you’re confined to a nursing home or care facility for over 90 days, Pioneer American will waive a percentage of your premiums until you’re out. You won’t get that with Americo or Fidelity.

As they say, the devil is in the details, which is why it’s best to work with an experienced insurance broker like Final Expense Direct. Our agents are waiting for your phone call to help you find the best rate for your age, health, and coverage needs. Plus, we know the ins and outs of these policies, so we can help you find the right company with the perks you want — even if you have to pay a few more dollars for them.

Conclusion

While Pioneer American Insurance Company isn’t the best choice for all seniors, they are a great option for seniors and veterans with multiple medical conditions. If you’ve been turned down or are only eligible for a modified or graded death benefit through your current life insurer, call us.

We work with many final expense life insurance companies like Pioneer American to help all seniors, especially those in our home state of Texas. At Final Expense Direct, we’ll help you figure out how much life insurance you need and match you with a company that offers the best rate and other perks so you can worry about more important things, like enjoying your retirement.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?

Enter your text here...