Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 16 Apr 2024

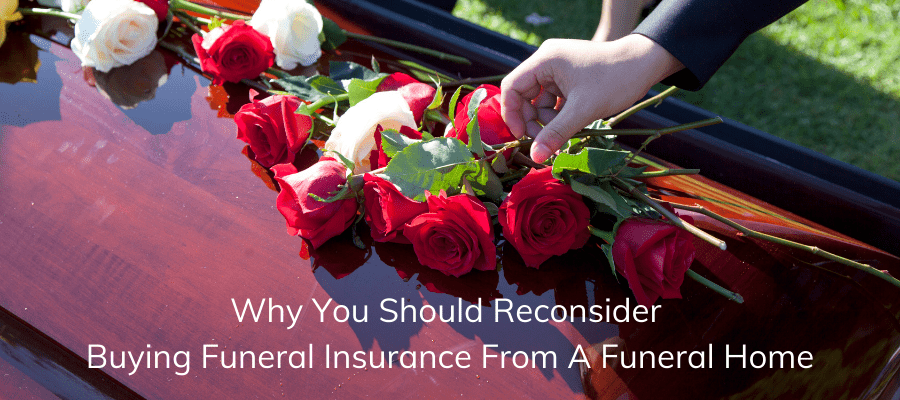

Are you looking for an inexpensive way to pay for your funeral expenses when you go home to the good Lord?

Are you worried about how your loved ones would be able to pay for your funeral if you were to die tomorrow?

Are local funeral home sales representatives or funeral directors calling you about buying their overpriced insurance funeral?

If they are, you want to read this before you buy a funeral insurance plan from a funeral home.

It could save you a lot of money.

Funeral Homes and What They Offer

Funeral homes want to be a one stop shop for people. You can buy everything you need to pre-plan your funeral, like:

- Gravestone

- Casket or urn

- Transportation to and from the cemetery

- Cemetery plot

- Headstone

- Funeral or cremation service

- Wake or visitation

- Minister or clergy for services

While it’s convenient, it’s not always in your best interest to buy everything from the funeral home. They’ll tack on fees anywhere they can to make you pay more, and they get to pocket the difference.

Funeral homes even offer life insurance to pay the costs of your funeral, so when you pass, your family doesn’t have to spend their time setting up the services or figure out how to pay for your funeral.

But is buying funeral insurance from a funeral home the best option?

Usually, it’s not—for you, anyway.

Funeral home insurance is expensive because they usually only offer the ‘named brand’ overpriced policy with the highest commission for them. While it does pay for your funeral when you die, it costs you more of your hard earned money you didn’t have to part with. And there won’t be anything left over if you want to leave a little something to your loved ones after you’re gone.

Don’t be sucked into the appeal of having the funeral home do EVERYTHING for you.

It may be convenient, but it comes at a high cost.

Not only can you shop around for all the funeral services and supplies you want at your wake, you can also shop for funeral life insurance.

If you are looking for insurance to cover your funeral expenses, please see our Final Expense article BEFORE you sit down with the funeral home to discuss options and costs.

We wanted to focus only on insurance sold by the funeral home to cover your final expenses because we have seen how predatory these practices can be. Meeting the good Lord is something everyone will have to do one day, but it’s hard to think about your mortality. Funeral homes easily take advantage of this, driving up the cost of goods and services during one of the most vulnerable times of your life.

It’s not right, or fair.

Though some people can get a deal with a TRUSTED funeral home, most are only out to sell you a insurance funeral policy that nets them the highest commission. Especially if they are reaching out to you unsolicited.

They aren’t out to save you money, that’s for sure. They’re just trying to make money off of you by giving you the least amount of coverage for the most amount of money. Solicitors are all the same, whether they’re trying to sell you an extended car warranty or funeral insurance.

Here’s what funeral insurance is, what plans they offer, and how to tell if it’s the best policy choice for you.

How Much Does Funeral Insurance Cost?

When you buy funeral insurance, the cost varies by company. Unlike traditional life insurance, which rates you based on your age, health, lifestyle, hobbies, and occupation, funeral insurance only considers your age, gender, and coverage amount. So why does the cost differ by company? It usually comes down to a different rating structure that calculates the base rates for each age group and gender, or there may be additional benefits included in the policy. Let’s take a look at some example rates to compare funeral insurance costs.

A 75-year-old male would pay $137.90 a month for funeral insurance with Pioneer American, but the same policy with AARP would only be $94.32 monthly. With Great Western, the same man would pay $158.75 per month, but just $105 monthly through Fidelity. AHL wouldn’t even offer him coverage, as their rates end at age 70.

Sample Male Guaranteed Life Rates for $10,000: Pioneer American vs Great Western (Compared)

Age | Pioneer American | Great Western |

|---|---|---|

Age 50 | $41.10 | $59.58 |

Age 55 | $51.75 | $64.58 |

$59.49 | $75.42 | |

$74.98 | $92.08 | |

Age 70 | $101.12 | $119.58 |

Age 75 | $137.90 | $158.75 |

$196.95 | $222.97 | |

Age 85 | $263.74 | N/A |

2022 Sample Quote for $10,000 Guaranteed life insurance rates for a healthy standard non-smoking individual. These are examples of rates that may or may not be available to you and you should not rely upon these numbers. Contact Final Expense Direct today to get your personal final expense insurance quote. 1-877-674-0236 Get Your Free Quote Today!

Now, let’s look at the same companies for an 85-year-old woman. Pioneer American would cost $211.47 per month, but she wouldn’t be eligible for AARP or Great Western funeral insurance because they stop offering coverage at age 80. With Fidelity, she could expect to pay $119.50 monthly.

Companies like Pioneer American offer the full death benefit from day one, which means you pay more for funeral insurance. AARP and Great Western have lower rates but have a graded death benefit. Great Western is more expensive than AARP because of its free accelerated death benefit rider. And with Fidelity, you can get guaranteed issue if you have health problems, but answering a few health questions can get you a lower rate if you qualify.

What is a Funeral Insurance Plan?

Funeral insurance is a life insurance policy designated to pay for your funeral costs. The funeral home contracts with a life insurance agent offering small whole life insurance policies.

At most funeral homes, directors choose the one who pays the highest commission per policy, even if the premium you pay is higher than other carriers.

Every time they get someone to buy a life insurance policy from that agency, the funeral home gets a cut of the sales agent's commission.

How Funeral Home Insurance Works

When you get a funeral insurance plan from a funeral home, here’s how it works:

- You choose which items and services you want

- The funeral home calculates the total cost

- They give you a quote for funeral life insurance based on the funeral cost

- You pay for the policy usually until you die

Depending on the cost of the insurance funeral, you could end up paying more in premiums than the total value of the policy.

Yes, in some cases, this can happen.

Why would you want to pay MORE than you’ll get out of a policy?

It makes little sense to us, and we bet it makes little sense to you, either.

Luckily, funeral homes have another option that could be a better choice.

Prepaid Funeral Expenses

If you balk at the price of funeral insurance, the funeral director might offer you a prepaid funeral plan instead. This is not life insurance, but a payment plan you pay directly to the funeral home in installments until the entire cost of the funeral is paid off.

You could pay additional fees to process each payment. There might even be a service charge built in just for the privilege of buying insurance funeral from their representative. This is another way a funeral home can make money off of you in addition to the cost you are paying for your funeral.

On the plus side, your loved ones won’t have to come out of pocket for your funeral costs once it’s paid off.

Right?

Not necessarily. If you choose the prepaid funeral plan option, your family could receive a bill if you die years down the road.

Why?

Because funeral costs tend to go up every year, just like the cost of a lot of things. We are all feeling the squeeze when we check out at the grocery store or fill up with gas these days.

Compare and buy

final expense

If you prepay your funeral now and don’t die for years, the cost could continue to creep up with inflation.

Here you are, blissfully unaware, thinking your funeral is already paid for. Years later, you die and your spouse finds out they need to cough up $2,000 to give you the funeral you wanted and already paid for.

Sounds unfair—and it is.

Imagine the stress and emotional trauma your family will have to go through if they have this unexpected expense to pay for. If they don’t pay, the funeral home will start asking them what services or items they no longer want, so the funeral home can get the cost down to what you paid for years ago.

How’s that for service in their time of grief?

Thankfully, there’s a better choice that is probably cheaper, with way more benefits for you and your family. It also gives you full control over your choice, instead of a funeral home sales rep or director making your decisions.

Pros of Prepaid Funeral Plans | Cons of Prepaid Funeral Plans |

|---|---|

How to Tell if Funeral Insurance is the Best Choice for You

If funeral home sales representatives are reaching out to you to sell you their services, here’s a great way to tell if the funeral insurance plans they offer is the best choice for you.

Allow them to provide you a quote on your ideal funeral service. Ask them to give you a detailed list of all the items and services you select, along with a cost breakdown for each.

Don’t worry, the Funeral Rule requires them to do this, anyway.

If they offer insurance funeral, let them provide you a quote. Ask for a copy of the quote, so you can find out what insurance company is offering the coverage, how much insurance they are offering, and how much it costs.

Thank them for their time and tell them you need to think it over before deciding.

Now, it’s time to find out if funeral insurance is the best choice for you, and not just the funeral home.

In the life insurance industry, funeral insurance is a generic term used for a small whole life insurance policy. Most often, it’s called final expense life insurance. This is life insurance specifically for seniors.

Why Final Expense Insurance is a Better Choice Than Insurance Funeral

With final expense insurance, you can get between $5,000 and $50,000 in life insurance. With many companies, you don’t have to take a medical exam to qualify. You just have to answer a few basic health questions to get covered.

When you buy funeral insurance, you get just enough life insurance to pay for your funeral. There’s nothing extra to pay for end-of-life expenses like medical care, legal fees, mortgage, car loans or credit card balances. Nothing you can leave for your grandkids. Just enough to pay the funeral home for your funeral.

Final expense insurance is different. You CAN get just enough coverage to pay for your funeral. But if you qualify for that amount of coverage, you can usually qualify for the maximum amount offered.

Why not get more coverage if you can afford it? If you want to leave a little something extra for your loved ones to remember you by, final expense life insurance might just be the best solution for you.

Funeral homes are a great resource for all things funeral and cremation related. They can source caskets and urns, put on a memorable funeral service, and help with getting obituary notices completed and submitted to the paper or find the right clergy to officiate.

Whatever you think final expense costs...

It's probably less.

No money down • No medical exam

Of course, this is what they do.

But funeral homes specialize in funerals, NOT life insurance.

What you need is a company that specializes in life insurance. Specifically, life insurance for seniors, AKA final expense insurance.

At Final Expense Direct, that’s ALL WE DO! It’s in the name, so you know it’s true.

Final Expense Direct works with a long list of the best final expense life insurance companies. We work directly with you to find you the best deal on final expense life insurance, so you can get the most coverage you can afford.

We are the one stop shop final expense life insurance equivalent of the funeral home.

Let them focus on what they’re good at, so we can focus on what we’re good at.

We wouldn’t sell you a coffin, because it’s NOT our specialty.

We can get you a great deal on final expense life insurance, though. And we can almost bet we can save you money compared to the funeral insurance policy you got a quote on earlier.

This is How Easy it is to Get a Quote for Final Expense Funeral Insurance

In just one phone call to Final Expense Direct, we can help you find out if that insurance funeral policy is the best choice for you and your wallet.

Here’s how easy it is to work with Final Expense Direct:

- Call us at 1-877-674-0236.

- Get connected directly with an agent. No automated hoops to jump through. We promise, a real live person will answer your call.

- Answer a few basic health questions. Based on your answers, our agents will help you choose the best plan for your needs.

- Get approved and pay for your life insurance.

Yes, it’s really that easy!

When you call Final Expense Direct, have that funeral insurance quote handy. We welcome the challenge to beat the quote you received, and hopefully be able to provide you more coverage at a better price.

We don’t focus on the highest commissions at Final Expense Direct. Our goal with every phone call is to provide the best protection for you and your loved ones at a price you can afford. That’s why we only work with the top final expense life insurance companies in the country.

When you work with Final Expense Direct, we can tell you what you won’t get:

- Gimmicks

- Sales pitches

- Pressure

- Funeral insurance plans that only covers your funeral (unless that’s what you want)

Our simple 4-step process was created to provide you peace of mind in one simple phone call.

Let the funeral home focus on what they’re the experts in, so we can focus on what we’re the experts in.