Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 24 Apr 2024

When you're in your 60s and beyond, it's easy to think that life insurance is just a way for companies to make money on older, less-healthy people. However, that's not the case at all.

As you get older, your risk of dying increases, and so does the likelihood that your family members will need help with funeral expenses.

In fact, according to the National Funeral Directors Association (NFDA), only about half of Americans die with pre-paid burial plans or wills in place.

To avoid potential problems after death, it's important for seniors to understand the different types of final expense insurance available and how each one can help them protect their families' finances after they've passed away.

In this article, we look at some of the reasons why you need senior care final expense insurance.

Senior Citizens are at Greater Risk for Health Problems

Seniors are at greater risk for health problems.

They're more likely to have chronic conditions, like diabetes and heart disease, which can be expensive to treat.

The more chronic conditions you have, the more likely it is that you'll need long-term care at some point in your life.

Long-term care can cost hundreds or thousands of dollars per month--and if you don't have insurance covering those costs, then they'll come straight out of your pocket (or through Medicaid).

Additionally, death is a part of life that no senior (or human, for that matter) can overlook.

Knowing the complications that come with the burial or cremation process, it is necessary that you have some sort of plan in mind to cover the costs.

Seniors Need Assistance with Burial Costs

You might think that the cost of a funeral isn’t an issue for seniors, but it can be quite significant.

The average cost of a burial rose by 9% between 2017 and 2018 to $8,000, according to the National Funeral Directors Association (NFDA).

And, if you live in an urban area or one with high real estate prices--like New York City or San Francisco--the price tag can be even higher: In Manhattan alone, funerals can cost upwards of $10,000 on average.

The NFDA also reports that final expenses vary depending on whether your loved one has health insurance coverage through Medicare and Medicaid; if they don't have health insurance then their final bills could be significantly higher than those who do have coverage.

Hospital bills can accumulate quickly, and if you don’t have health insurance, those outstanding medical bills can fall into the final expenses left to your loved ones. In addition, bills from deductibles and co-pays are often left to family members as well.

Family Members Need Help Planning a Funeral

With all the other things going on in your life, it's easy to forget about planning for funeral expenses.

But if you've ever dealt with a loved one's death, then you know how important it is for family members to have this information at their fingertips.

Your loved ones might not be prepared for planning your funeral.

It is important for you to have a plan in place to take care of some of the financial burden during what will already be a very difficult time for them.

However, this isn't always possible due to financial limitations or a lack of knowledge about what options are available when someone passes away unexpectedly.

With final expense insurance, seniors can ensure that the costs of a funeral are taken care of properly and family members can recover from the grief of death without worrying about expenses.

Life is Unpredictable

Life is unpredictable, and it's better to be prepared than surprised. You never know what will happen.

You don't want to leave your family with unexpected expenses at a time when they are grieving over the loss of a loved one.

You also want to make sure that your final wishes are carried out in accordance with what you've planned.

The average cost of a funeral today is around $8,000—but that figure can be significantly higher depending on where you live.

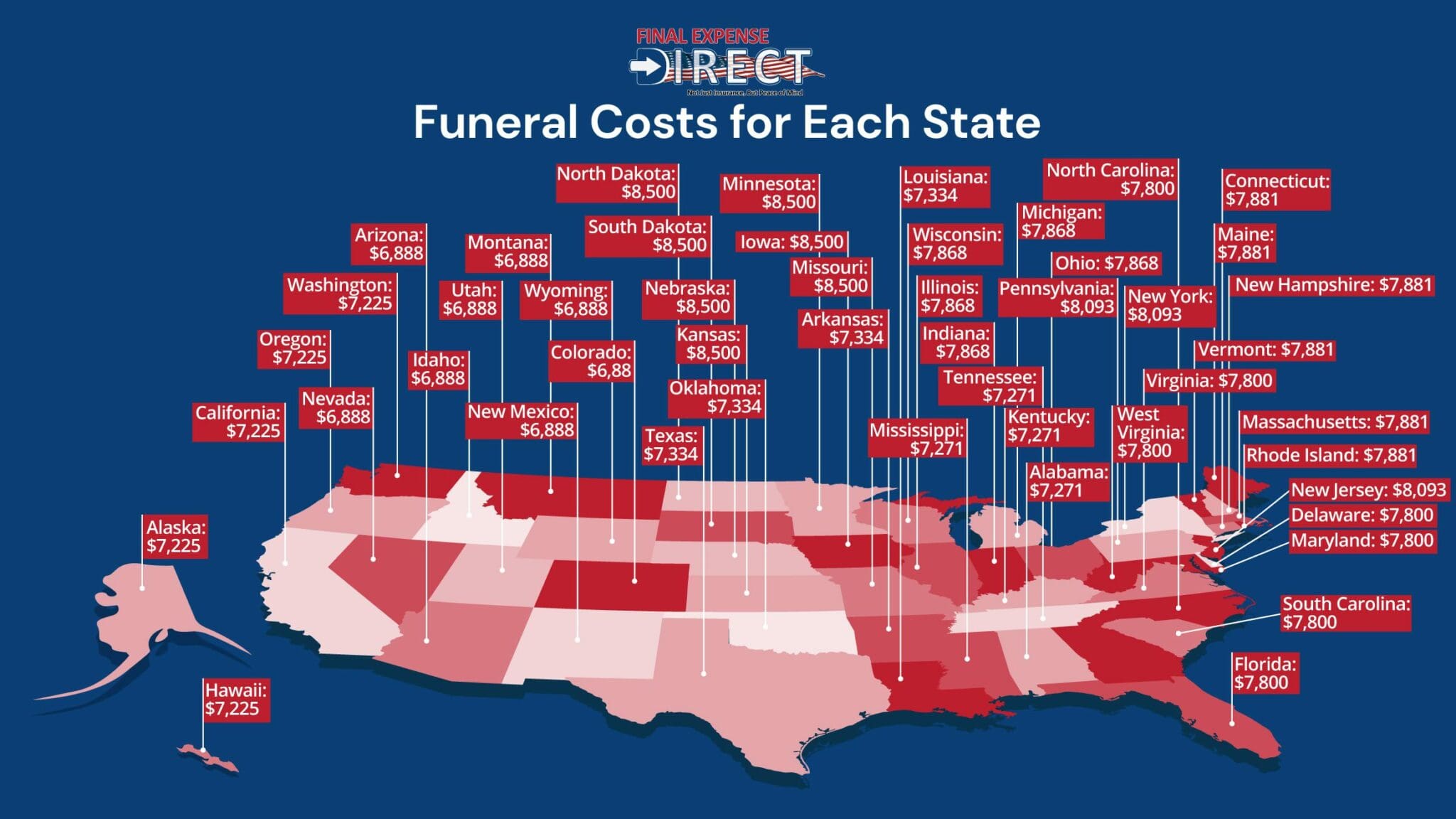

Here is a breakdown of what you can expect to pay for a funeral in each state:

In many states, there are laws governing what happens when someone dies without having made arrangements for their burial or cremation.

Without any sort of advance planning, your loved ones are responsible for footing the bill and making sure that your wishes are fulfilled once you pass away.

What is the Best Senior Care Final Expense Insurance?

Senior care final expense insurance policies typically have low coverage amounts and premiums and are designed to be simple and easy to obtain, with a focus on providing quick access to funds in the event of death.

Every senior care final expense insurance will cover funeral expenses such as embalming, cremation memorial services, as well as things like an opening and closing of the grave site (or urn vault), transportation of the body to another state, and more.Plans can cover as much or as little as you want, depending on the death benefit you choose to purchase. There are no restrictions to what your beneficiary(s) can use the funds for.

You can also purchase supplemental coverage in case there are unexpected costs associated with your death, like a medical emergency or long-term care facility stay that wasn't planned.

The most important thing when choosing senior care final expense insurance is making sure it fits into your budget!

Be sure to give us a call to find the best insurance coverage for you before signing up so that you know exactly what each plan offers and how much it will cost over time.

Tips to Find Cheap Final Expense Insurance

If you're looking for affordable senior care final expense insurance, here are some tips that can help you:

Consider a smaller coverage amount

If you only need to cover basic expenses, such as cremation costs, consider a smaller coverage amount to reduce the monthly premium.

Apply for a simplified issue policy

Simplified issue policies do not require a medical exam, which can make the process faster and less expensive.

Choose a level premium

A level premium means that the cost of the policy will remain the same for the duration of the policy, making it easier to budget for.

Avoid riders and added benefits

Additional riders and benefits can add to the cost of the policy. Consider if you really need them and if not, opt-out of them to save money.

Shop around for the best price

You can do this by comparing quotes from multiple companies.

Make sure to use an independent agent who is not affiliated with any particularinsurance company and will help you find the policy that's right for your needs.

At Final Expense Direct, we have experienced independent agents that can price-shop all of the best companies for you at once, to make sure that you’re getting the best price for your needs and budget.

Remember, it's important to compare coverage options, terms and conditions, and premium costs carefully before making a decision.

Final Thoughts

We hope that this article has helped you understand why seniors need burial and final expense insurance

We also want to remind you that it's never too late to get started on planning for your own burial and funeral expenses. If this is something that concerns you, then please contact us today so we can help!