Final expense insurance, also known as burial or funeral insurance, is a small whole life policy with affordable premiums. It’s meant to pay for your funeral and other burial costs. Final expense insurance doesn’t require a medical exam, and most health problems are accepted. Benefits normally range from $5,000 to $40,000 with most companies. So, you may know how final expense insurance works, but where should you buy it? Which companies are the best?

Below, we’ve identified the top 10 final expense insurance companies for 2020. We made our selections based on the plans’ cost, coverage amount, state availability, and speed of approval, as well as the company’s financial track record.

Final Expense Direct represents all of these insurance companies.

1) Mutual of Omaha

Eligible Ages: 45 to 85

Death Benefit Types: Level & Graded

Coverage Amount: $2,000 – $40,000

State Availability: All states except NY

Mutual of Omaha has been in the business of offering insurance and financial products since 1909. Founded in Omaha, Nebraska, Mutual of Omaha maintains a clear code of ethics and business conduct. Mutual of Omaha currently has approximately $31 billion in total assets under management – and due to the company’s focus on values, it is one of the most respected insurance companies in the industry today.

Mutual of Omaha is often rated the best price for final expense insurance. In addition to low premiums, they can insure an array of health issues and most people can get approved for their immediate benefit plan. Mutual of Omaha also has outstanding life insurance for children.

The Living Promise coverage offers two separate death benefit plans — level and graded.

- Level pays out 100% beginning day one

- Graded contributes 110% of all paid premiums if you pass within policy years one and two.

- 100% of the death benefit will pay out beginning year three.

The level plan also offers a free policy rider that can advance a share of the death benefit for a qualifying chronic or terminal illness, or a permanent constraint to a nursing home facility. Overall, Living Promise Whole Life is our #1 choice for final expense/burial insurance cost and coverage.

2) Liberty Bankers

Plan Name: Life SIMPL Preferred

Eligible Ages: 18 to 80

Death Benefit Types: Level & Graded

Coverage Amount Range: $3,000 – $30,000

State Availability: All states except CT, MA, MN, NH, NY, RI

Life SIMPL offers level benefit coverage with two risk categories — preferred and standard. The maximum coverage is $30,000. Applicants with health conditions who don’t qualify for the level benefit plan might qualify for the graded plan, which has a maximum death benefit of $20,000.

- In year five of the policy, the death benefit equals 105% of the actual coverage amount.

- In year six, it’s 110%.

If you’re looking for a company with a strong insurance background and lenient underwriting, go with Royal Neighbors of America.

3) American Home Life

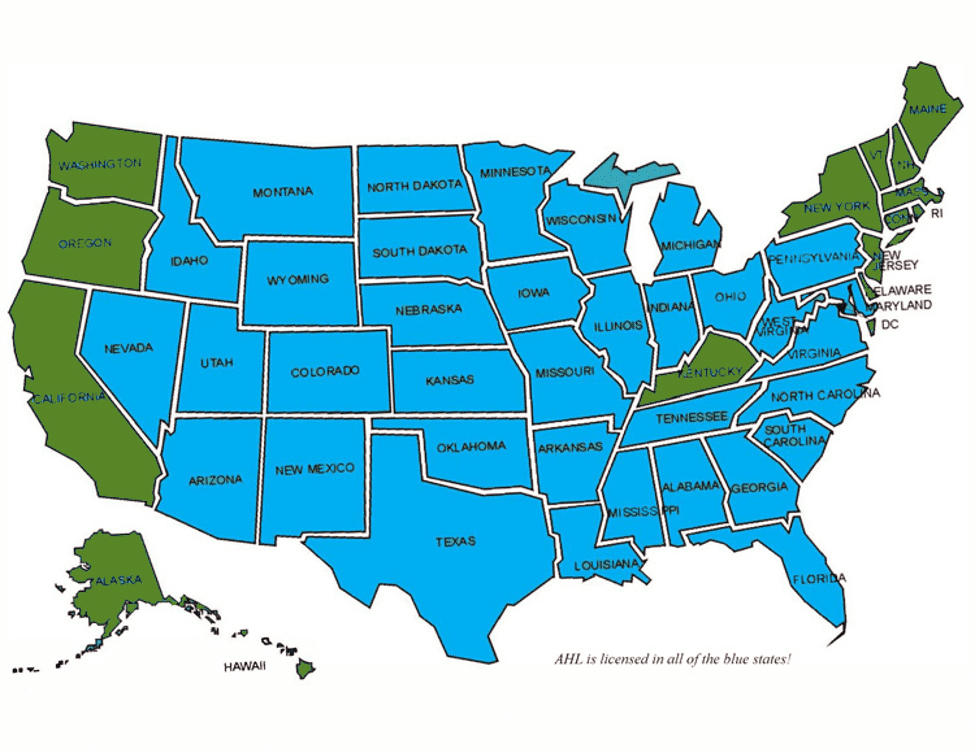

For over 100 Years, American Home Life has served middle market consumers by offering a comprehensive product portfolio of both traditional and final expense life insurance products, fixed annuities and more! American Home Life conducts business in the following states:

History

American Home Life Insurance Company (AHL) was founded in 1909 in Topeka, Kansas under the name Kansas Home Mutual Life Insurance Company. In 1912, the company merged with American Mutual Life Insurance Company of McPherson, Kansas and adopted its current name – American Home Life Insurance Company– which the company has operated under for over 100 years. Throughout the last century, American Home Life’s mutual corporate structure, conservative investment philosophy, and Midwestern value-oriented culture have enabled AHL to grow and prosper through multiple World Wars, epidemics, and recessions while fulfilling its commitments to its policyholders, agents and employees.

AHL was founded and operates today as a Mutual insurance company. A mutual insurance company is simply a company that is owned exclusively by its policyholders; it has no shareholders and is not publicly traded on any exchange. The distinction is very important because it means AHL can solely operate in policyholder’s long-term interest without having to weigh the effects company decisions may have on shareholder’s short-term interests. As a result, AHL is superiorly positioned to navigate its way through unexpected future financial or political events and is ultimately better able to fulfil its obligations to its policy holders both on time and in full when we’re needed most.

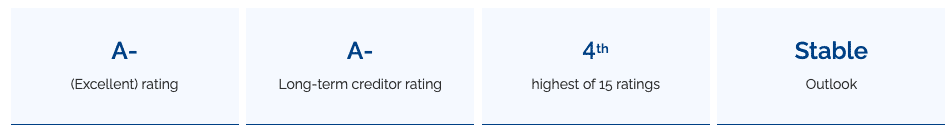

A long-term and conservative investment management philosophy has always been the foundation of AHL’s financial strength and stability. AHL’s asset management team deploys capital into the marketplace under a highly customized, conservative investment strategy which prioritizes ongoing, long-term financial solvency above all else. AHL’s past and present performances has earned the company a “Stable Outlook” rating from AM Best, the industry’s leading ratings agency. AHL’s portfolio is currently and will remain well positioned to continue fulfilling its obligations to policyholders now and into the future, regardless of the financial climate of the day.

Your best funeral insurance policy may be with Foresters Financial, depending on your health.

5) Pioneer American

Home office in Waco, Texas, Pioneer American is a member of the American Amicable Group of companies which has been insuring families since 1910– for over 107 years. It was acquired by Industrial Alliance Insurance and Financial Services Inc. in 2010. The company contributes to the well-being of over 4 million individuals and employs more than 5,000 people, and manages and administers, over $109 billion in assets.

The Company continues to grow and prosper and has consistently maintained a solid financial position. American-Amicable Life Insurance Company of Texas is a part of the American-Amicable Group, which was acquired by Industrial Alliance Insurance and Financial Services, Inc. in 2010.

Historically anchored on a foundation of financial integrity, responsible management, and a strong commitment to every policyholder, American-Amicable Life Insurance Company of Texas looks to the future with great enthusiasm.

6) AIG

Plan Name: Guaranteed Issue Whole Life (GIWL)

Eligible Ages: 50 to 85

Death Benefit Types: Guaranteed Issue

Coverage Amount Range: $5,000 – $25,000

State Availability: All states except ME, NY, & PA

American International Group (AIG) offers guaranteed issue life insurance, which is a policy with no medical exam or health questionnaire. Your acceptance is guaranteed and approval for coverage can be made in just minutes. All guaranteed issue policies have a 24 month waiting period before they will pay out a death benefit. If you pass away during this time, AIG will refund 110% of premiums paid.

AIG offers some of the lowest premiums for guaranteed issue coverage and they’re the only carrier that offers free terminal and chronic illness riders on each policy. Guaranteed issue policies are normally a last resort, but they do help high-risk applicants who can’t qualify for a plan that has underwriting.

Common Health Issues They Accept: HIV or AIDS, Dialysis, Angina, Oxygen Use, Current Internal Cancer, CHF, Dementia or Alzheimer’s, Wheelchair-Bound Due to Disease

AIG only offers what’s called Guaranteed Issue Life Insurance. This kind of policy has no health questionnaire or medical assessments. Your acceptance is guaranteed. As is the case with all guaranteed issue policies, there is a 24 month waiting period before the policy will pay out a death benefit. Should death occur during this time, AIG will merely refund 110% of premiums paid.

7) Prosperity Life Group

Plan Name: New Vista Level Benefit

Eligible Ages: 50 to 80

Death Benefit Types: Level, Graded, and Modified

Coverage Amount: $1,500 – $35,000

State Availability: All states except CT, DE, DC, HI, MT, ND, & SD

Prosperity Life Group may not have the brand recognition of some of the other companies. But they feature an excellent funeral insurance plan that is suitable for many people. Non-cigarette smoking tobacco or nicotine users can all obtain a non-tobacco rating. Prosperity will only apply a tobacco price to folks who smoke cigarettes, which can lead to massive savings for you.

Coverage choices include level, graded, and modified benefit plans. Qualification is based on your health history.

- The level plan death benefit is the same as the full coverage amount beginning day one.

- The graded plan offers a benefit that equals 30% of the total death benefit in year one, 70% in year two, and in year three, 100% of the actual death benefit.

- The modified plan in year one features a benefit of 110% of the annual premium, 231% of the annual premium in year two, and beginning year three equals 100% of the actual death benefit.

- There’s an optional accidental death benefit rider that can be added no matter what plan you qualify for.

Prosperity Life has made a competitive product that gives many people instant coverage when they’d otherwise get a two year waiting period. They could be the best insurance company for you.

AM Best financial strength ratings (as of January 1, 2021)

Prosperity has an aggregate of $16 billion of life insurance in force, 350,000 policies, $2.6 billion of assets and has been meeting the needs of the middle market consumers for over 100 years.

9) Baltimore Life

Plan Name: Silver Guard I and II

Eligible Ages: 50 to 80

Death Benefit Types: Level & Graded

Coverage Amount Range: $2,500 – $25,000

State Availability: All states except MA, MN, MO, NY, NC, SC, WA, WV

Baltimore Life is the only company that will offer partial coverage to people with severe recent health problems. These health issues would induce a full two-year waiting period with nearly every other carrier.

Silver Guard I is the level of death benefit plan with a maximum death benefit amount of $25,000.

Silver Guard II is the graded death benefit plan, which allows many high-risk conditions like recent heart attacks and cancer.

- The death benefit in year one is 25% of the actual death benefit and 50% in year two.

- The maximum death benefit is $15,000.

If you don’t mind paying slightly more to get some immediate coverage and you’ve recently had a high-risk health incident, Baltimore Life Insurance might be your best choice.

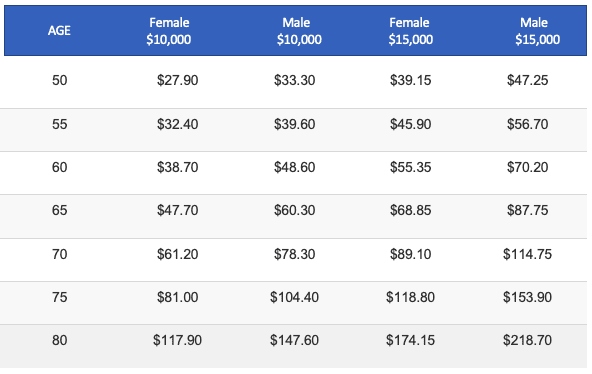

Baltimore Life Premiums

**Plans do not expire after 80**

Personal Life Insurance Products

Baltimore Life’s product portfolio* features a wide range of insurance products to address your family’s needs:

Protector and aPriority™ Level Term Life Insurance

Affordable term life insurance for temporary needs offering life insurance for a specified period to cover specific needs. Products offer guaranteed level death benefit, guaranteed premiums during initial coverage period, an option to convert to permanent life insurance, and a choice of coverage periods – 10, 15, 20 or 30 years. You can enhance your coverage with optional riders.

Advantage and aPriority™ Whole Life Insurance

Provides lifetime coverage at a level premium that does not increase as long as premiums are paid as planned. Products offer guaranteed cash values that increase each year on a tax-deferred basis. Dividends may also be paid annually.

Silver Guard® I and II

Whole life insurance for seniors ages 50-80 for final expense protection. Benefits include guaranteed level premiums, guaranteed cash value accumulation, and an insurance policy that is guaranteed non-cancelable as long as premiums are paid.

Lifetime Navigator® and aPriority™ Universal Life Insurance

Combines the affordability of permanent life insurance, flexible premiums, and a built-in lifetime insurance protection guarantee feature. It is designed especially for individuals wanting long-term protection for their families and businesses at a competitive premium.

Generation Legacy®

A tax-efficient way to leave a legacy behind for those you love – Generation Legacy allows the transfer of funds from non-qualified annuities and other qualified plans, and offers an easy, tax-efficient way to pass a significantly larger gift from these proceeds to your heirs. You can also receive a portion of your death benefit while living in the event of a terminal illness, nursing home confinement, or if you need extended care such as home health care or adult day care. Generation Legacy combines a life insurance policy and annuity contract and is available for individuals ages 60-80.

Single Premium Whole Life

Allows the transfer of cash funds such as CDs and Money Market accounts – SPWL provides an easy way to pass a significantly larger gift from these proceeds to your heirs. You can also receive a portion of your death benefit while living in the event of a terminal illness, nursing home confinement, or if you need extended care such as home health care or adult day care. This life insurance product is available for individuals ages 50-85.

Critical Illness Insurance

Provides for medical expenses associated with key critical illnesses, including cancer, heart attack, kidney failure, major organ transplant or stroke. Critical illness coverage provides cash that may be used for expenses not usually covered by health insurance, such as home health care, “experimental” treatments, lost income of spouse or caregiver, copays and deductibles.

*These product descriptions are not a contract and descriptions of policy provisions are only partial. Policies and riders may not be available in all states. Refer to the individual policies referenced for complete terms and conditions.

Great Western

GWIC makes qualifying for Final Expense insurance straightforward and easy by offering two whole life plans: Assurance Plus and Guaranteed Assurance.

Assurance Plus is designed for those in good health, looking for additional value. If you can answer “no” to three simple health questions (four in Florida), you will qualify for a 25% increase of the full death benefit starting on day one with no required medical exam.Plus, the Accelerated Death Benefit rider* is included at no additional charge on the Assurance Plus plan. This one-time benefit provides you with access to some of your policy benefit to cover medical expenses or supplement income if you are diagnosed with a chronic or terminal illness as defined by the policy. You would receive the present value of the death benefit, and any remaining values would be paid to your beneficiaries upon death.

Guaranteed Assurance** provides coverage with absolutely no underwriting and no health questions to answer.

- If at any time a death occurs by accident as defined in the policy, the full death benefit will be paid.

- If a death occurs in the first two policy years, and is not an accidental death, the benefit paid will be 110% of the premiums paid to date.

- After the first two policy years, regardless of how the death occurs, the full death benefit is paid.

In short, GWIC’s plans are affordable, simple ways to secure your family’s financial future because:

- Your premiums will never go up.

- Funds can be used for any purpose.

- Your 30-day satisfaction is guaranteed.

- Coverage builds cash value over time that is tax deferred and can be borrowed against.

Call Final Expense Direct

If you need additional help finding the best final expense insurance company, we’re here for you. Final Expense Direct is currently licensed in 49 states and the District of Columbia, aiding tens of thousands of customers with their final arrangements. We can shop and compare your coverage with multiple companies. Call 1 (877) 674-0236 to speak with a licensed insurance agent.