Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 26 Apr 2024

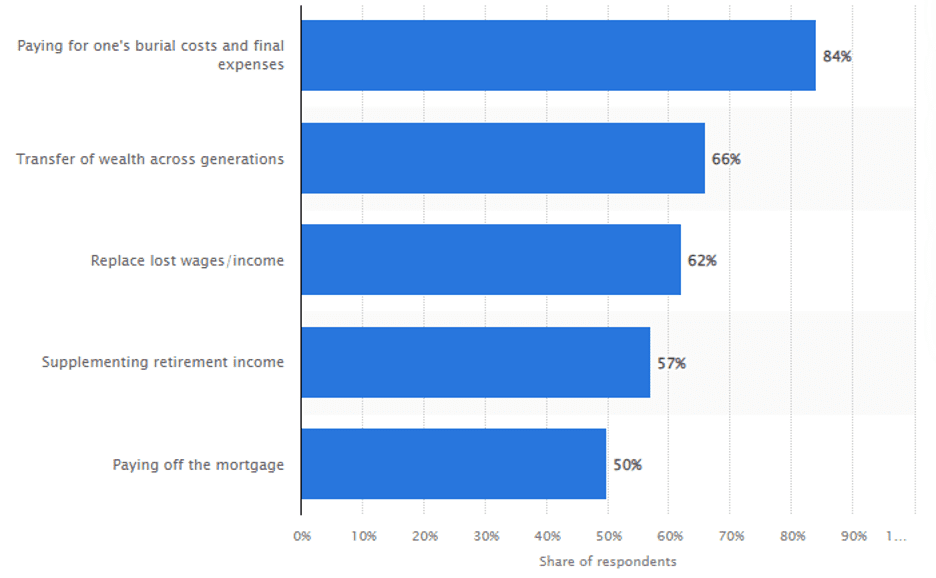

A 2020, survey showed that most seniors, owned life insurance to pay for their burial costs and associated final expenses.

Here is a graph showcasing individual preferences recorded in the survey.

As the price of funerals in the US rises every year, it's no surprise that people are more inclined towards final expense insurance.

However, what about the cost of the insurance premiums associated with final expense insurance?

In this article, we take a closer look at final expense insurance costs, how they are predicted to change over the coming months (and years), and the benefit you get as a result.

We will also look at whether these policies are worth the risk in today’s economy and how these policies come into effect after you pass away.

Why Buy Final Expense Insurance In The First Place?

Over the past 30 years, the average funeral cost has grown much faster than the overall consumer price index.

Governments’ benefits are designed to help families, but the most they will pay is $255.

That leaves a difference of almost $5,000 to $9,000 depending on the services chosen – which can prove very difficult for your family.

This is where final expense insurance comes into play.

Also known as a burial policy, these are life insurance policies designed to help people set cash away for the ultimate ‘rainy day.’

The idea is to make small contributions into an insurance account in the form of premium payments and get the benefits that insurance policies offer.

This way, you can prepare for your funeral without it becoming a financial burden for your family leaving behind memories, not financial heartache.

Final expense insurance policies are affordable alternatives to traditional insurance policies and are favored among seniors over 60

Most final expense insurance policies don’t require a medical exam, and the premium amounts are much smaller with an emphasis on covering your funeral and associated costs.

Difference Between Traditional & Final Expense Insurance Policies

Life insurance policies are designed to replace a families’ lost income as a result of an unexpected death, to pay off a mortgage, and to have money available to feed, clothe and educate children.

What makes final expense insurance different is it's purpose to pay for end of life expenses.

This includes funeral costs, burial expenses, headstones, cemetery plots, and any medical or other debt left behind at the time of passing.

Sample Rates

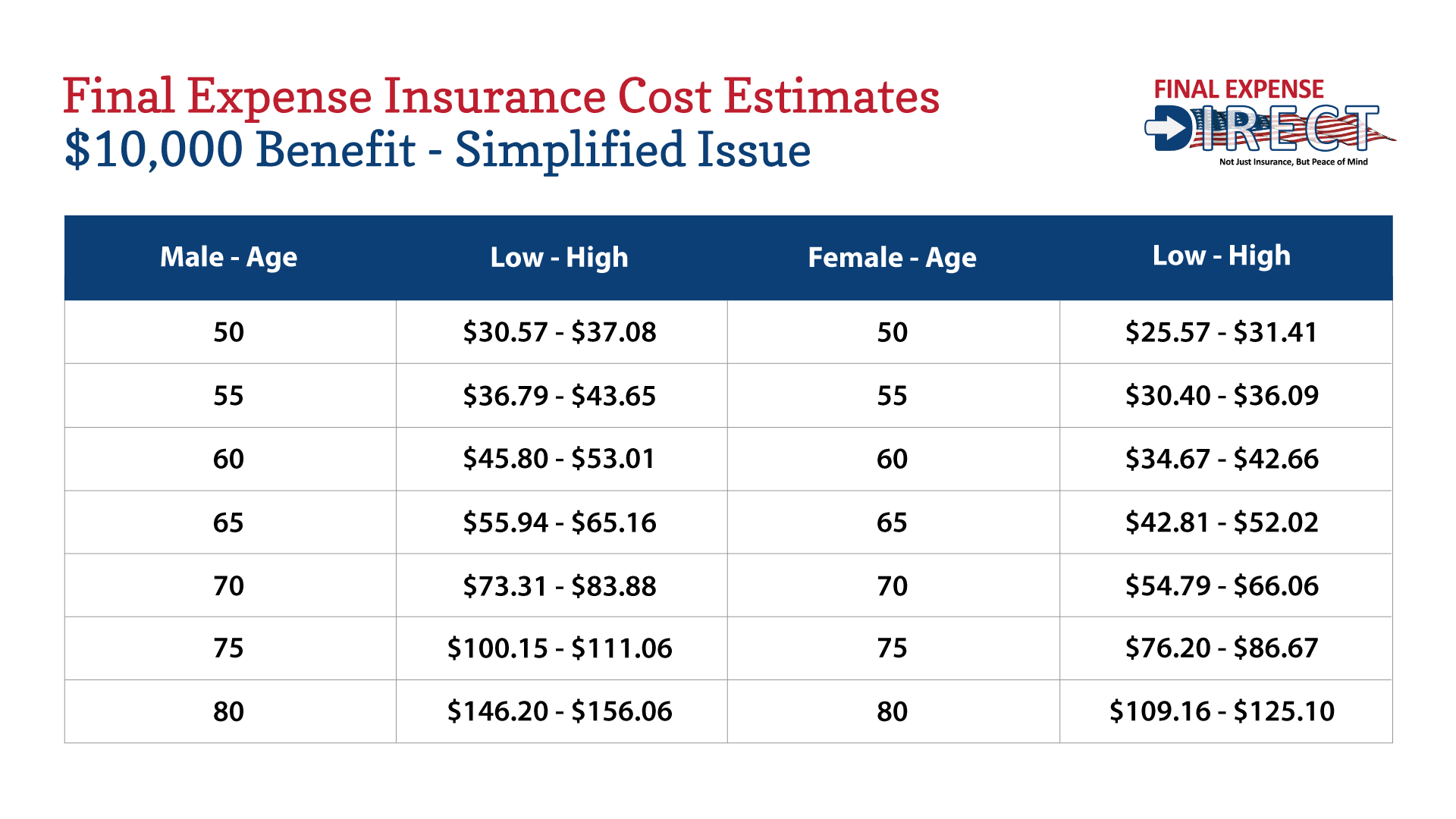

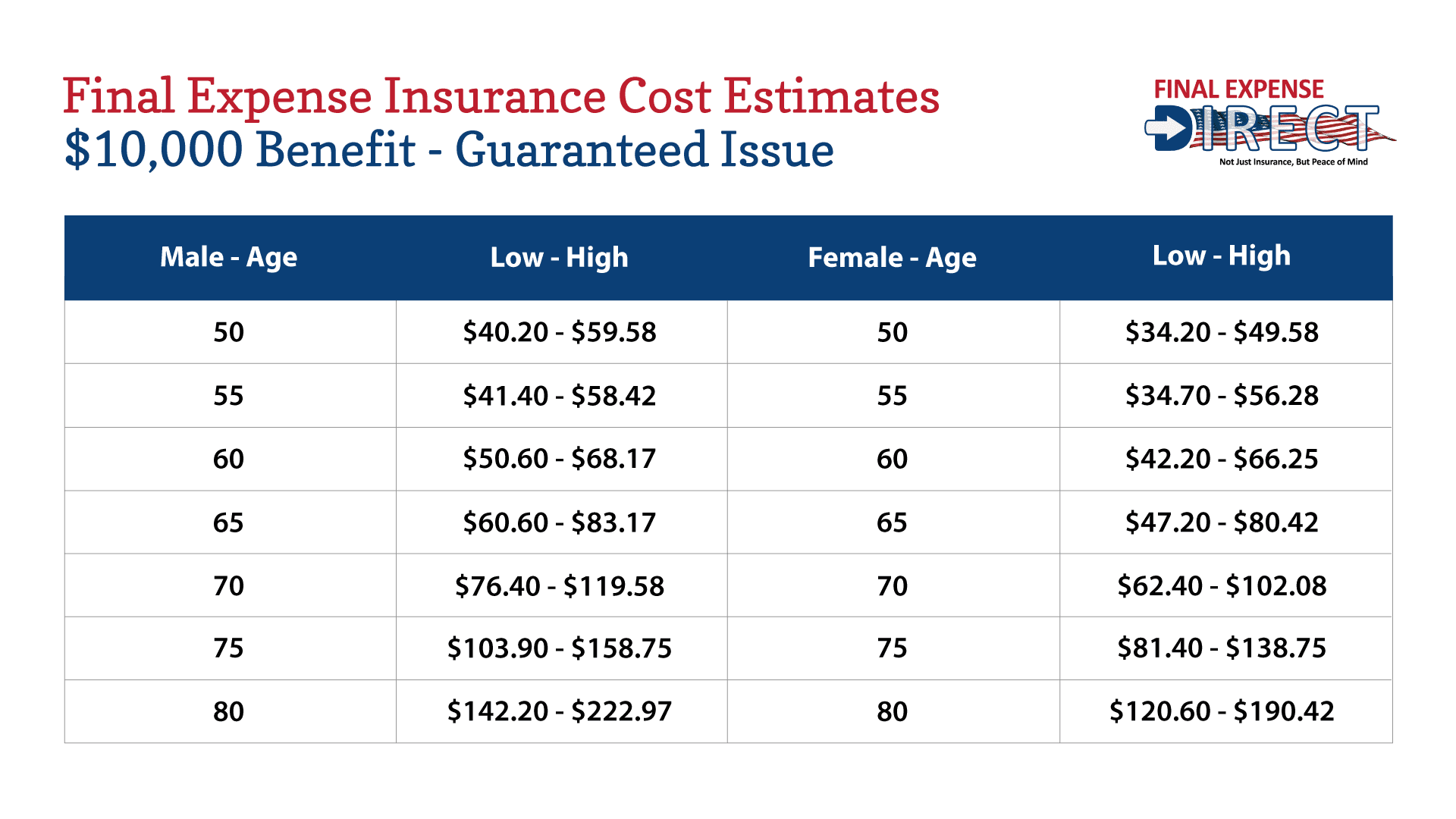

The death benefit you receive and the monthly premium you have to pay will vary with age and health.

Your premiums might be higher depending on your health at the time of purchase.

That's why it’s always best to purchase a policy sooner, rather than later, so you can lock the rates while younger and in better health.

It is no secret that with age, the risk of death also increases – especially for those over 70.

That’s why you will notice that the insurance rates will vary with respect to your age and health, which we will discuss in a later section.

Here is an overview of the average cost of burial insurance for males and females:

It is important to note that these rates are based on rates for 2023 and for seniors with standard health and no tobacco use.

An important benefit of final expense insurance is that they don’t expire like term policies.

The coverage continues as long as you keep paying the premiums. The rate you are approved for at the time of purchase will be the rate you pay for LIFE, even as your age and health changes.

Factors That Impact The Rate Of Insurance Expenses

As mentioned above, the biggest factor that impacts how much final expense insurance costs for you is your age at the time of signing the policy.

However, that is not to say that there aren’t other factors involved as well. Here are some things that impact your final expense insurance rate.

Medical Conditions

There is no medical exam to qualify for the final expense insurance policy, however the approval of a final expense/burial policy is based solely on your age and health at the time of the application.

Therefore, a short medical questionnaire about your health is required for a lower rate.

Expected Funeral Costs

Funeral costs can vary based on what kind of service you and you family wish to have.

On average, here are the costs you can expect to pay for a funeral:

- Casket: $2,500

- Cremation casket: $1,300

- Urn: $295

- Basic service fees: $2,300

- Cremation fee: $368

- Embalming: $800

- Body cleaning and other preparatory services: $275

- Facility/staff fees: $550

- Hearse: $325

- Funeral van: $150

- Printed material: $183

- Service food: <$500

- Obituary: $200 - $500

There are different tiers of caskets, coffins, flowers, memorial stones, cemetery plots, and other miscellaneous services that can easily take a $7,000 funeral to $25,000 or more.

Beneficiaries of Final Expense Insurance

It is important to discuss this with your family members before signing the policy.

You can either include them as a beneficiary in the policy, or assign a certain amount of money from the proceeds of the policy to them.

The decision is ultimately yours, but you should always consider their feelings and wishes when deciding on what’s best for them.

The most common beneficiaries we see are:

- Your spouse or partner

- Your children, grandchildren, or other relatives

- Any charitable organization

- Your lawyer or power of attorney

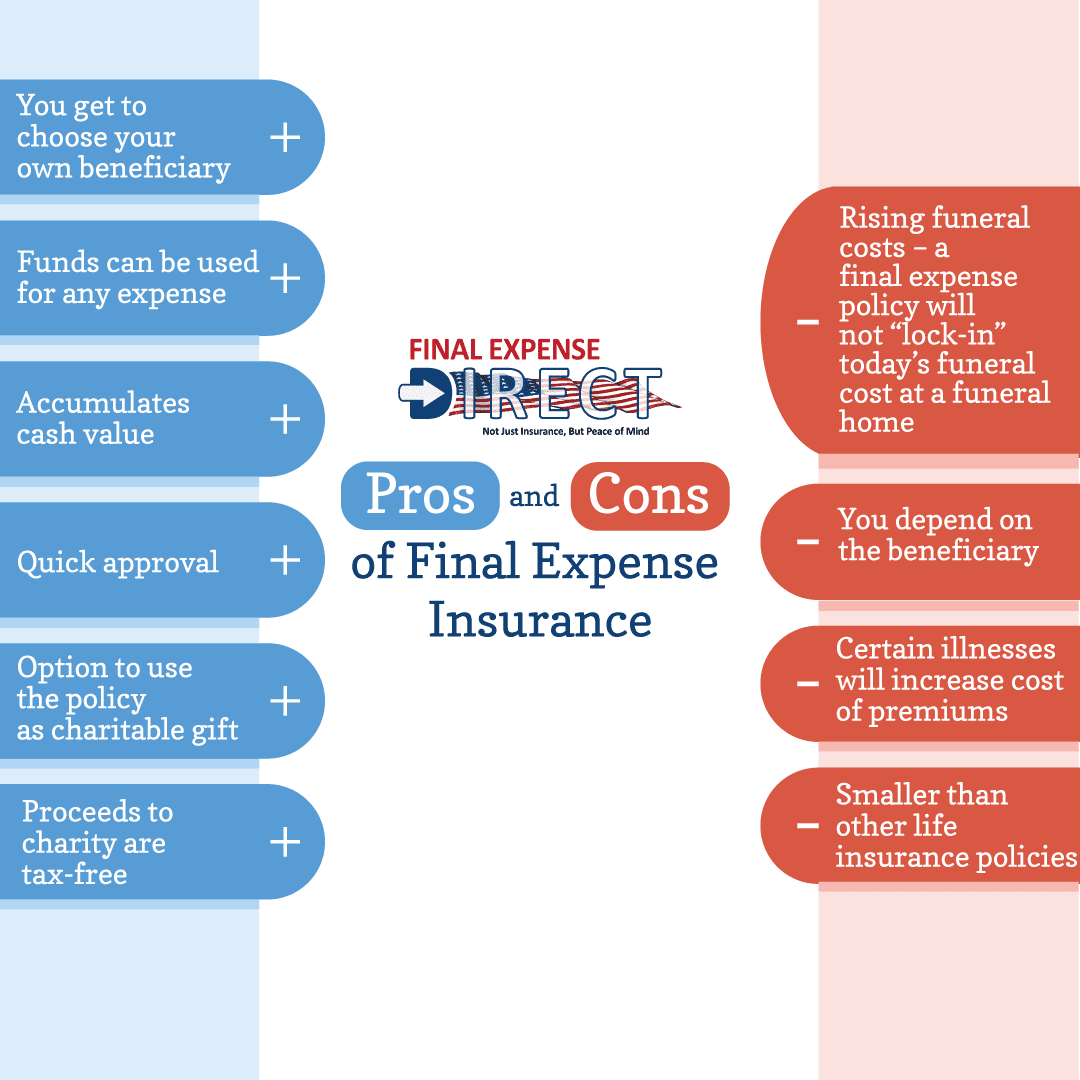

Pros and Cons of Final Expense Insurance

Final expense insurance does what it's intended to do; cover your final expenses and ease financial burden on your family.

Here are the pros and cons of final expense insurance:

Different Benefit Levels of Final Expense Insurance

Every company is different, but most providers offer 3 types of final expense insurance:

- Traditional Immediate Benefit

- Graded/Modified

- Guaranteed Issue

Burial Insurance – Tips To Reduce Premiums

Whatever you think final expense costs...

It's probably less.

No money down • No medical exam

When trying to reduce final expense insurance premiums, there are three tips we can share:

- Shop around and compare rates from different providers

- Work with an independent agency or broker that represents multiple insurance companies.

- Apply for your policy sooner rather than later.

All of these tips will help make sure you are getting the best deal on your final expense insurance policy.

Final Words

Final expense insurance is an important part of ensuring that your loved ones have financial protection when you pass.

It’s important to take time when choosing a policy.

Make sure to research different providers and compare rates before making a purchase.

An independent agency can do the shopping for you and assist with obtaining the best policy at the best price.

By considering all of your available options you can ensure that you’re obtaining the right final expense insurance policy to give you and your family financial peace of mind.

Final Expense Direct is a great place to start your search for the perfect final expense policy.

Call us today for a free quote and start on this important process!