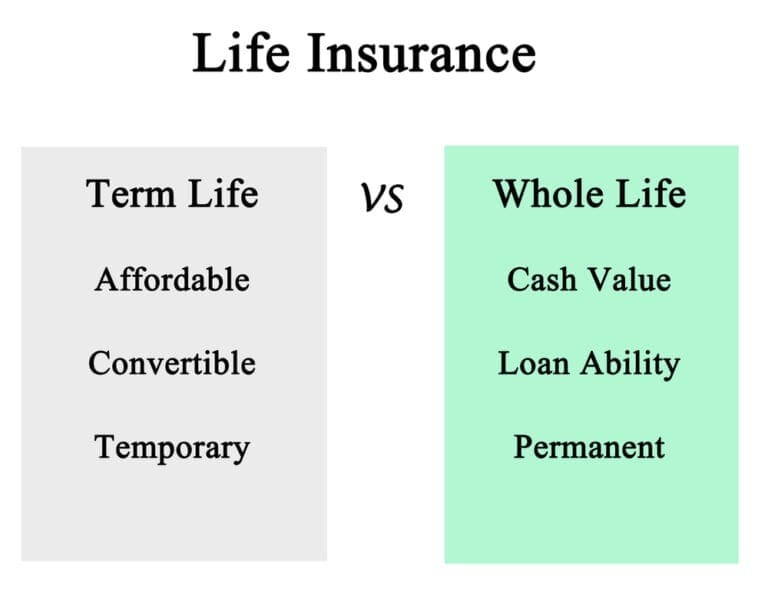

Should I Buy Burial Insurance for My Parents?

Burial insurance is an excellent way to plan ahead and greatly reduces the financial burden burial can cause. Burials can be expensive, and there may be more costs associated with them than you realize. Buying burial insurance for your parents can provide you with the peace of mind that comes from knowing you’re prepared and can provide