Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 26 Apr 2024

What Is Life Insurance for Seniors?

Life insurance for seniors is specific life insurance policies that are geared towards those aged 60 and older. Seniors have unique needs for life insurance compared to younger generations. If you’re a senior and don’t currently have life insurance, it could be harder to get the coverage you need at a price you can afford. Your age and health are the most important factors for a life insurance company, and depending on both, it may surprise you to find out how expensive life insurance can be.Why Do I Need Life Insurance?

If you don’t already have a life insurance policy, you might need one. Ask yourself this question: If I were to die today, would my loved ones be able to afford to live without me? If the answer is no, then you need life insurance.

How Much Life Insurance Do I Need?

The amount of life insurance you need is usually different when you’re older. Seniors usually buy life insurance to pay for end-of-life expenses like medical bills and funeral costs. If you need life insurance, here are a few things to consider. The average funeral with a burial and viewing costs $8,805 in the United States. If you prefer a cremation, it’s less expensive at $6,515.

End-of-life expenses can vary greatly by where you live, your health insurance, and if you are ill and need care until death. Most end-of-life care occurs in hospice, palliative care, or respite care, which can be extremely expensive. Research suggests that Medicare pays one quarter of its spending each year on the 5% of people who will die in the next 12 months. In 2018, Medicare paid over $365 Billion in end-of-life care across the country. The average cost per person for end-of-life medical care is over $13,000, but can be well over $100,000 or more for the sickest people.

If you're curious about the difference between Medicaid versus Medicare, we wrote a whole article outlining everything you need to know.

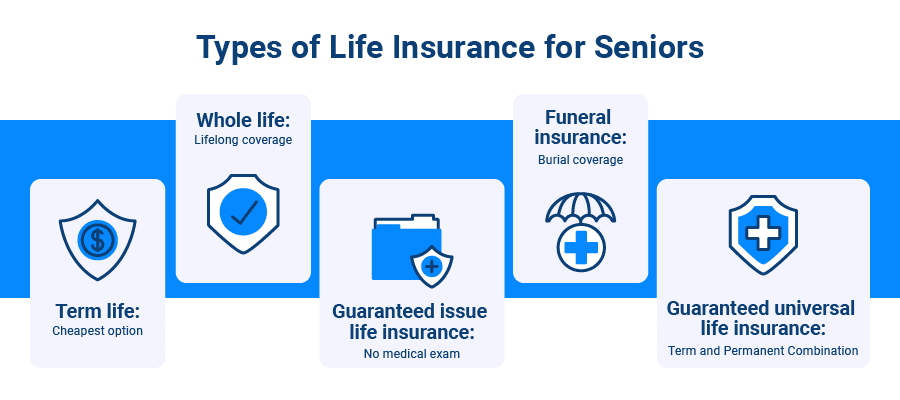

Life Insurance Policies for Seniors

If you don’t already have life insurance, then the most cost effective choice is final expense insurance. This type of life insurance is a whole life insurance policy that can build cash value. There are a few ways you can use the cash value while you’re still alive, but it can’t be combined with the death benefit once you die.

There are four options available for final expense insurance and the way you answer the health questions on your application will determine what you qualify for. But don’t worry, we can get you insured with any of them here at Final Expense Direct.

The four types of final expense life insurance are:

Level benefit

Graded benefit

Modified benefit

Guaranteed issue

Level Benefit Life Insurance for Seniors

If you are generally healthy and can answer no on the life insurance application, you should qualify for level benefit or immediate final expense life insurance. When you purchase level benefit life insurance, 100% of the death benefit becomes available the day you buy it. So, if you get off the phone with Final Expense Direct after purchasing your policy and a tree falls and kills you or you get hit by a bus, your beneficiary will be paid the full death benefit.

A level benefit policy has the most coverage available at the best price. If you qualify for this policy, you will get the best deal on seniors life insurance.

Graded Benefit Life Insurance for Seniors

If you don’t qualify for a level benefit final expense policy, you may be able to get graded benefit life insurance. This policy is for someone who:

- Answers yes to one or more health questions

- Has some health concerns

- Is outside of the preferred height and weight range

- Is taking a medication that disqualifies them for a level benefit policy

Unlike a level benefit policy that provides 100% of coverage immediately, a graded benefit limits the death benefit payout. The graded benefit policy has a 2 or 3 year waiting period. If you die within the waiting period, your beneficiary only gets part of the death benefit amount. The length of time and death benefit amount varies by insurance company.

Death in the first year means they will get between 20%-30% of the death benefit amount. If you die in the second or third year, your beneficiary usually gets 70% of the death benefit. If you die in the third year or later, they will get the full death benefit amount.

With a graded death benefit final expense life insurance policy, the premium is usually higher and you may be limited in the death benefit amount. If you don’t qualify for a level benefit policy, we will work to get you insured with a company that pays the most benefit the soonest.Modified Benefit Life Insurance Seniors

If you have serious health problems, you may not qualify for a graded death benefit policy. If not, then you may qualify for a modified benefit life insurance policy. It has the same 2 or 3 year waiting period as the graded benefit, but the payout is different.

With a modified benefit life insurance policy, your beneficiary only gets the premiums returned with interest if you die during the waiting period. So, if you pay $1,200 into your modified benefit life insurance and die in the 20th month, your beneficiary only gets $1,200 plus interest. This policy is more expensive than a graded benefit policy and you may be limited on how much death benefit you can buy. If the best you can qualify for is a modified benefit policy, we will work to place you with the best company offering 100% of the death benefit as soon as possible.Guaranteed Issue Seniors Life Insurance

If you have severe health concerns, you may not even qualify for the modified benefit life insurance policy. In this case, the best option is a guaranteed issue life insurance policy. This policy doesn’t have any health questions, so as long as you can afford the premium, you are guaranteed to be accepted.

As you may suspect, this policy is the most expensive option available. It offers a graded death benefit with a 2 or 3 year waiting period. If you die during the waiting period, your beneficiary only gets the premium returned with interest. The maximum amount of coverage you can qualify for is usually $25,000, which is enough for a funeral and some left over. While this is the last resort life insurance policy, we can get you placed with the best life insurance companies offering guaranteed issue life insurance with just one phone call.Best Term Life Insurance for Seniors

If you’re a senior under 70, you may still qualify for term life insurance coverage. Unfortunately, the most you’ll qualify for is a 10-year term. This means you’ll pay for life insurance for 10 years and then the policy runs out. If you don’t die in those 10 years, then your policy cancels and you’re left older and without life insurance.

Compare and buy

final expense

Best Guaranteed Seniors Life Insurance Plan

A guaranteed senior life insurance plan is best for seniors who have serious health problems. If you can’t qualify for senior lifes insurance with a few health questions and no medical exam, your next best option is guaranteed life insurance for seniors. There are no medical questions to answer and you can’t be turned down.

This is the most expensive option to get life insurance as a senior, but it may be your only option. When you work with Final Expense Direct, we’ll answer all your questions and also ask you a few about your health. Depending on your answers, we’ll work to place you with the best life insurance for seniors, leaving guaranteed senior life insurance as the last option.Best Guaranteed Universal Life Insurance Seniors

Guaranteed universal life insurance for seniors is best for someone who wants permanent life insurance coverage with a fixed premium. As long as you continue to pay the premiums on time, coverage stays in place until a specific age, usually between age 90 and 100 or older. Some seniors can find a guaranteed universal life insurance policy is actually cheaper than term life insurance with the same death benefit, and it will last longer than the term policy, too.

Guaranteed universal life insurance is less expensive than non-guaranteed universal life insurance because it’s not tied to the stock market. At your age, you’d be better off paying down your mortgage or saving the money elsewhere. You can use guaranteed universal life insurance to fund a trust, plan your estate, maximize your pension, or leave an inheritance to your loved ones.

Best Guaranteed Acceptance Whole Life Insurance for Seniors

Guaranteed acceptance whole life insurance for seniors is another one of the best choices you can make compared to term life insurance. Like universal life insurance, your coverage won’t change and neither will your payment. Depending on the life insurance company, coverage usually stays in place until at least age 95, but usually to age 100 and beyond.

With guaranteed acceptance whole life insurance, you won’t need to wait around for approval. Instead, you’ll get instant approval and be covered immediately. Rates start at just $10 per month, so you can get coverage you can afford and sleep easy knowing your loved ones have peace of mind when you pass and won’t be financially burdened.

How to shop for Senior life insurance

Shopping for senior life insurance doesn’t have to be hard! It’s easy to get overwhelmed with the amount of life insurance companies offering coverage, the types of policies available, and the ways you can customize your coverage. Before you start to get overwhelmed about shopping for life insurance, review these steps so you know what to expect. This is the best way to shop for senior life insurance.

Take Your Time - Get Free Quotes

Shopping for life insurance can be a process. The first step is to get free quotes. You should NEVER have to pay for a life insurance quote! If someone asks you to pay just to receive a price for senior life insurance, run away!

Before you shop around for life insurance, you should have an idea of the type of policy you need and the amount of coverage you want. This way, when you get senior life insurance quotes, you can compare the same policy type and coverage to know you’re getting the best price.Talk To A Professional

There’s no need to understand everything about life insurance before you shop — that’s what the professionals are for! Licensed insurance agents know all the ins and outs of life insurance for seniors.

Our agents at Final Expense Direct have over 35 years of experience and we only deal with senior life insurance. Why spend more time than you have to trying to understand life insurance before you can even shop? Instead, make 1 phone call to Final Expense Direct, speak with a professional, and get approved before you get off the phone.

Yes, we really make it that easy. Our job is to find you the best deal on senior life insurance with one of the top rated companies we work with. We do all the shopping for you (after we determine your needs), so you can spend your time doing the things you love.

Whatever you think final expense costs...

It's probably less.

No money down • No medical exam

How Much Life Insurance Do I Need?

Another reason to talk with a professional is to find out how much life insurance you need. You don’t want to buy too much life insurance and risk not being able to afford it once you have it.

Buying just what you need and can afford ensures you can keep the policy in place until you die so your beneficiary can get the death benefit. Nothing more, nothing less.

Determine if you need a rider

Some life insurance for seniors policies come with riders, which are additional coverage options you can include in your life insurance policy. You may not need a rider at all, or you might find out there is a rider that could benefit you. Just another reason to speak with the professionals at Final Expense Direct, so we can help you determine if you need a rider. Remember, our goal is to provide peace of mind for you and your loved ones. That includes getting you the coverage you need and can afford.

When Are You Too Old to Buy Life Insurance?

Unfortunately, you can reach a point when you are too old to buy life insurance. The age limit depends on the type of life insurance and the insurance company. Here are a few of the top life insurance companies to give you an idea of when you are too old to buy life insurance.

Life Insurance Company | Maximum Issue Age |

|---|---|

AAA Life Insurance | 100 |

AARP | 80 |

AIG Direct | 89 |

Alfa Insurance | 80 |

Americo | 75 |

Colonial Penn | 85 |

Fidelity Life | 85 |

Gerber Life Insurance | 80 |

Mass Mutual | 90 |

Mutual of Omaha | 85 |

Vantis Life | 80 |

Can I Buy Life Insurance Over 50

Yes, you can buy life insurance over 50. The rate you pay depends on your age and your health, but at 50, you can usually get term or permanent life insurance easily. If you want final expense life insurance for seniors, 50 is usually the minimum age you can apply for it. You’ll get the best rates for seniors life insurance in your 50s, especially if your health is good.

Can I Buy Life Insurance For Seniors Over 60

Yes, you can buy life insurance for seniors over 60, including term and permanent life insurance. Your health will determine which coverage maximum you can qualify for and if you need guaranteed issue life insurance. If you're healthy, you might get the best rates by taking a medical exam and allowing the insurance company to fully underwrite the policy.

However, if you’re over 60 and have some health concerns, level benefit life insurance for seniors is probably your best choice. You still have to answer a few health questions, but you won’t have to take the medical exam to prove your health.

Will I Qualify for Life Insurance for Seniors Over 70

Yes, you will qualify for life insurance for seniors, even if you’re over 70. If you’re still pretty healthy, you might get level benefit final expense life insurance. If not, then you can buy guaranteed issue life insurance at any point in your 70s. If you’re unsure about what type of life insurance for seniors over 70, call Final Expense Direct at 1-877-674-0236. We’ll help you qualify for the best life insurance for seniors plan with a top rated life insurance company.

Can I Obtain Life Insurance if I’m 70+ Years Old with Pre-Existing Health Conditions?

While some seniors 70 and over are pretty healthy, most have at least one health issue that can affect getting life insurance and how much it costs. The insurance companies call any health problem you have when you apply a pre-existing condition. Some pre-existing conditions won’t get you denied, but it can make the premium more expensive than you need to pay for life insurance. Other more serious problems, like cancer or heart disease, could mean you get denied for coverage.

Pre-existing conditions can make it harder to find coverage, but it’s not impossible. You shouldn’t have to spend precious time away from your grandkids and living your golden years on finding life insurance. At Final Expense Direct, we know what it's like to need life insurance but not be able to afford it. That’s why we work with the best life insurance companies to get you covered, even if you have health issues. We only ask a few questions to find out how healthy you are so we can get you the best life insurance policy that you can afford.Is It Possible to Get Life Insurance for Seniors Over 80?

Life Insurance For Seniors over 80 may find it more difficult to get life insurance, but it is possible. Some companies limit their issue age — the maximum age you can be to get coverage — to 80 or 85. Term life insurance is not an option for seniors over 80 because the risk of you dying during that time is too high.

If you’re a senior over 80 looking to get life insurance, final expense life insurance is most likely going to be your best choice for affordable life insurance coverage. The healthier you are, the more life insurance coverage you can get at a cheaper rate.

What Are the Expected Costs of Life Insurance for Seniors?

The expected costs of life insurance for seniors are based on your age, health, and coverage amount. Term life insurance is the cheapest type of life insurance, but it only lasts for so long. Depending on your age when you get term life insurance, you may only have coverage for 10 years. If you outlive your policy, you’re now 10 years older, your health may be worse, and now you’re more limited on what you can get. Plus, life insurance will be more expensive because you’re older, even if your health hasn’t worsened.

Guaranteed life insurance for seniors is more expensive than term life insurance for a few reasons:

You’re getting coverage for life instead of a few years

You don’t have to answer qualifying health questions

A medical exam isn’t used to determine how health you are so the insurance company can charge you more

How Much Does Life Insurance for Seniors Cost?

Life insurance for seniors costs vary by company, even for the same coverage amount. If you can answer “no” to a few health questions on the application, you can usually get a cheaper rate with simplified issue life insurance for seniors compared to guaranteed issue. And the younger you are when you apply, the better your rates. Let’s compare the cost of life insurance for seniors, a man 60-years-old and a female 80-years-old.

For the 60-year-old male, life insurance for seniors would cost $52.16 per month through Americo, but the same policy with Liberty would be $45.80 monthly. Life insurance coverage for this senior through Great Western would be $75.42 each month. At Mutual of Omaha, the same coverage for him would be $42.76 a month.

Looking at the same companies, Americo would charge $132.12 monthly for an 80-year-old woman. Liberty’s life insurance for seniors rate would be $109.16 per month and Great Western’s cost for the same policy is $190.42 a month. The woman would pay the least through Mutual of Omaha, $98.43 each month.

Why are the rates so different? Great Western’s high cost can be attributed to its free accelerated death benefit rider and 25% death benefit increase if you can answer “no” to the application health questions. Both Americo and Mutual of Omaha offer guaranteed issue life insurance for seniors, which costs more than simplified issue because there are no health questions.

Sample Female Guaranteed Life Rates for $10,000: Mutual of Omaha vs Great Western (Compared)

Age | Mutual of Omaha | Great Western |

|---|---|---|

Age 50 | $24.67 | $49.58 |

Age 55 | $28.40 | $56.25 |

Age 60 | $32.87 | $66.25 |

$41.01 | $80.42 | |

Age 70 | $53.24 | $102.08 |

$72.41 | $138.75 | |

$98.43 | $190.42 | |

Age 85 | $135.90 | N/A |

2022 Sample Quote for $10,000 Guaranteed life insurance rates for a healthy standard non-smoking individual. These are examples of rates that may or may not be available to you and you should not rely upon these numbers. Contact Final Expense Direct today to get your personal final expense insurance quote. 1-877-674-0236 Get Your Free Quote Today!

$10,000 Estimated - Guarantee Issue Life Insurance Cost By Age

Age | Male | Female |

|---|---|---|

Age 50 | $40.20 | $34.20 |

Age 55 | $41.40 | $34.70 |

Age 60 | $50.60 | $42.20 |

Age 65 | $60.60 | $47.20 |

Age 70 | $76.40 | $62.40 |

Age 75 | $103.90 | $81.40 |

Age 85 | $142.20 | $120.60 |

These estimated guarantee issue life insurance rates are based on a standard issue, non-tobacco applicant. These sample quotes are not an offer and are for informational purpose only. To find out your actual rates contact Final Expense Direct today.

Affordable Seniors Life Insurance

The closer you are to 50, the better your chances are of getting affordable life insurance for seniors. If you’re relatively healthy and not older than 75, you might qualify for term life insurance. Most term life insurance companies cap their 10-year term life insurance at 65, so your options may be more limited after you turn 65 if you want term insurance.

Compare and buy

final expense

Remember, term insurance is temporary insurance. It will eventually run out and if you are still alive, you’re back to needing life insurance again at an older age or paying a much higher rate at the age you are when it expires, which most seniors can’t afford.

Permanent life insurance like universal and whole life may be more expensive initially, but they are a better option for affordable life insurance for seniors. Your coverage stays in place for life and your rates never increase.

What Is the Cheapest Life Insurance for Seniors?

Depending on your age and health, the cheapest life insurance for seniors is usually going to be final expense insurance. It gives you enough of a death benefit for your beneficiary to pay for your funeral and have some left over. If you can answer “No” to a few health questions, you can get an even better rate for senior life insurance than someone who needs guaranteed life insurance coverage.

If you’re not sure what the cheapest life insurance for seniors option is, give us a call at Final Expense Direct. We’ll find you the best rate with the most coverage.

Seniors Life Insurance FAQ

Are there life insurance policies designed specifically for seniors?

Yes, life insurance for seniors is a specific type of life insurance designed specifically for this age group. Senior life insurance is a whole life insurance policy that offers a level death benefit at a level premium. The policy stays in place until you die, as long as you keep payments current. Once you pass away, your beneficiary gets your death benefit as defined in the senior life insurance policy you purchased.

What is the best life insurance for a senior in poor health?

If you’re a senior in poor health, the best life insurance policy is guaranteed issue final expense insurance. This life insurance policy for seniors doesn’t have health questions or a medical exam. You are guaranteed to be approved for this type of senior life insurance, but it is the most expensive option available.

What can a senior do if they no longer need their life insurance?

If you are a senior and find you no longer need your life insurance, you can cancel it. If you have a term life insurance policy, you can just stop paying for it or let your agent know you want to cancel it. If you have a senior life insurance policy or other permanent life insurance coverage, you should speak with the insurance company to see if you can surrender the policy and get the cash value returned to you.

How can I get money out of my life insurance policy?

How you can get money out of your life insurance policy depends on the type of life insurance you have. If you purchased senior life insurance, or final expense insurance, there may be cash value in the policy you can use as a loan or withdrawal. You’d have to speak with the insurance company or your agent to find out if you have money you can get out of your life insurance policy. If you do, there’s a chance any money you take could lower the death benefit or be considered taxable income, so be sure you understand the impact it has before you take money out.

Whatever you think final expense costs...

It's probably less.

No money down • No medical exam

When Does the Policy Kick In?

The policy kicks in after the waiting period on the senior life insurance policy. Some policies kick in immediately after you submit the application and make a payment, which is called binding the policy. Others don’t kick in until the policy is issued or may have a graded death benefit for a certain number of years, which means only the premiums and interest are paid if you die during that time.

What If I Have a Medical Condition?

Just because you have a medical condition doesn’t mean you can't be covered. Life insurance for seniors is made especially for those who are at or past retirement age, who are usually less healthy than younger age groups. The type of medical condition and severity will determine what type of seniors life insurance you qualify for.

What Happens if I Die After my Term Life Insurance Policy Ends?

If you die after your term life insurance policy ends and you didn’t get another policy put in place, it means you die without life insurance for your beneficiary. This could prove financially devastating to your family if they depend on you for income. Life insurance for seniors doesn’t have a policy end date like term life insurance. When you buy senior life insurance, your beneficiary will get paid when you die as long as the policy was paid until your death.

What if I Waited Too Long to Get Life Insurance?

If you’re still alive, you haven’t waited too long to get life insurance! The older you get, the fewer options you have for life insurance and the more expensive it can be. But if you need life insurance as a senior, now is the best time to get life insurance for seniors, which is tailored life insurance specifically for you.

What Is the Gerber Life Grow-Up® Plan?

The Gerber Life Grow-Up® Plan is a permanent, or whole life, insurance policy parents and grandparents can purchase for their kids or grandkids. You can buy between $5,000 and $50,000 in life insurance and when the child becomes 18, the policy amount doubles. If you buy $10,000 in life insurance from Gerber, it doubles to $20,000 on their 18th birthday. The child can also buy more life insurance at certain ages and be guaranteed coverage, no matter what their health is like.