Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 25 Apr 2024

What Is Burial Insurance?

Burial insurance is life insurance for seniors. It’s a small whole life insurance policy specifically created for seniors that covers funeral costs and end-of-life expenses. Life insurance for seniors starts at age 50.

The healthier you are, the more life insurance coverage you can get for a cheap price. Most burial life insurance plans are capped at $50,000 in coverage, though others may offer more depending on your age and health when you apply.

How Does Burial Life Insurance Work?

Burial insurance for seniors works as a contract between the policyholder and the life insurance company. The policyholder pays a premium amount to the insurance company, who agrees to pay a death benefit to the policyholder’s chosen beneficiary when they die.

The specifics on how much of the death benefit is paid depends on the type of burial insurance policy you qualify for. You only have to answer a few health questions to qualify, and you don’t have to take a medical exam to get funeral insurance. You can get approved the same day you apply for a funeral insurance policy, which is usually a longer process when you get traditional life insurance.

Burial Insurance Cost

Burial insurance costs are based on your age, where you live, and your health. The younger and healthier you are, the cheaper burial life insurance is.

How much coverage you choose also affects how much you pay for burial insurance for seniors. The more coverage you need, the more you pay for burial insurance policy, but the more your beneficiary gets when you die.

Payout

The payout amount is the same as the death benefit. This amount is listed in your life insurance contract, and what the insurance company agrees to pay to your beneficiary when you pass away.

Before your beneficiary can get the death benefit payout, they will have to fill out a form and provide the death certificate. It can take a few days to a couple of weeks to get the payout, depending on the contract details.

Who Needs A Burial Insurance Plan?

Burial life insurance is life insurance for seniors who need some money to pay for their funeral and any remaining small debts, like end-of-life expenses. If you’re a senior without life insurance, but your loved ones can’t afford to pay for your funeral, you need burial insurance.

Not sure where to begin? Getting burial life insurance for seniors doesn’t have to be complicated. Final Expense Direct is an independent agency that works with the best final expense life insurance companies.

Questions to Ask Before Buying Burial Life Insurance

When you’re ready to buy funeral insurance, there are some questions you should ask before you sign up for a policy. You don’t want to buy burial insurance just to be surprised down the road by a sudden premium increase or coverage change!

Before buying funeral insurance, be sure to ask these questions:

- Will the premiums ever increase?

- Will the policy terminate at any age?

- Will the coverage ever decrease in value?

- Is there a waiting period for non-accidental death

If you’re working with another insurance company or agency, and they answer “Yes” to any of these questions, give us a call at Final Expense Direct. We’ll work with you to get you covered with no surprises—now or in the future!

Pros and Cons of Burial Insurance

Pros

Burial life insurance for seniors starts at just $10 a month

You don’t have to take a medical exam to get approved

There are policies available that don’t require health questions

Burial life insurance probably costs less than you think it does

You can get burial life insurance regardless of your health

Burial insurance plans are a permanent life insurance policy

Your beneficiary can pay for your funeral and cover other expenses after you’re gone

Burial life insurance can allow your family to grieve when you’re gone instead of stress about how they’re going to pay for your funeral

Cons

- The older you are, the more expensive burial life insurance can be

- The worse your health, the more you pay for burial life insurance

- Burial life insurance for seniors doesn’t offer as much of a death benefit as other types of life insurance

- Not all burial life insurance pays the full death benefit right away

- You won’t get the best deal on burial life insurance if you don’t work with a reputable insurance company or independent agency like Final Expense Direct

A Must Read: The Best Final Expense Insurance Companies

What's Covered by Burial Insurance for Seniors

Though burial insurance is marketed to seniors to cover funeral costs and final expenses, you can use burial insurance plans coverage to pay for anything. Most companies cap coverage for burial life insurance at $50,000 though, so what you can use it for may be limited.

Burial life insurance covers most types of death, but there is a suicide clause for the first two policy years in all life insurance policies. If you die by suicide before the third policy year, your beneficiary won’t get the death benefit amount. Except for a few other exclusions that can vary by life insurance company, burial life insurance covers other causes of death.

Compare and buy

final expense

Types of Burial Insurance Plans

When you buy burial life insurance, there are different types of plans you can get. Make sure you understand which type of burial insurance plan you are buying before you make the purchase.

Level/Preferred

Level or preferred burial insurance for seniors is for seniors in good health. If you qualify for level burial life insurance, the full death benefit amount is available as soon as you complete the application and make your first payment. If you get hit by a bus tomorrow, your beneficiary gets the whole death benefit, even though you’ve only made one payment.

Partial/Graded

With a partial or graded burial life insurance plan, your beneficiary won’t get the full death benefit if you die in the first two or three years of the policy. If you die during that waiting period, your beneficiary will receive a partial amount of the death benefit.

For example, if you die in the first year, they would get 30% of the death benefit, but in year two they get 70%. This type of burial insurance policy is for someone who has some health issues and can’t qualify for preferred coverage.

Modified

If you have serious health issues, like heart disease or Alzheimer’s, you might not qualify for a graded death benefit. A modified death benefit is similar, but is more expensive and only returns the premiums you paid plus interest to your beneficiary if you die during the waiting period.

Guaranteed Issue

Guaranteed issue burial life insurance is for seniors who are in poor health and won’t qualify for modified or better. There are no health questions to answer or a medical exam to take. If you can fill out and sign the application and make payments, you’re approved.

This is the most expensive option, but will get you some coverage for final expenses. This policy also has a graded death benefit and may include living benefits that give you some access to funds if you are diagnosed with a chronic or terminal illness.

How Much Burial Life Insurance Should I Buy?

How much burial insurance you should buy depends on your goals for the policy. If you only want enough coverage to pay for your funeral costs, you probably only need $10,000-$15,000 in burial life insurance.

But if you want to have coverage to pay off debts or for other reasons, you might need more burial insurance coverage. If you’re not sure how much burial insurance you should buy, our agents at Final Expense Direct can help you decide which coverage amount is right for you.

How Much Does Burial Insurance Cost?

For many Americans, the cost of burial insurance makes a big difference in the coverage they can afford. When you buy burial insurance, how old you are, your gender, and how much coverage you need determines how much you’ll pay. The younger you are when you buy burial insurance, the cheaper your policy will be. Let’s take a look at how much burial insurance will cost for a 50-year-old male compared to a 70-year-old female.

For the male aged 50, coverage with Colonial Penn would be $29.65 a month, but with Americo, the same man would pay $39.97 per month. The same policy with AIG would be $51.92 monthly while Prosperity only costs $34.52 each month.

Sample Female Guaranteed Life Rates for $10,000: Colonial Penn vs Americo Compared

Age | Colonial Penn | Americo |

|---|---|---|

Age 50 | $21.28 | $34.08 |

Age 55 | $27.42 | $37.89 |

$35.84 | $41.34 | |

$47.43 | $52.83 | |

Age 70 | $65.68 | $65.60 |

$94.07 | $86.89 | |

N/A | $132.12 | |

Age 85 | N/A | $196.69 |

2022 Sample Quote for $10,000 Guaranteed life insurance rates for a healthy standard non-smoking individual. These are examples of rates that may or may not be available to you and you should not rely upon these numbers. Contact Final Expense Direct today to get your personal final expense insurance quote. 1-877-674-0236 Get Your Free Quote Today!

Now, let’s see what the rates would be for the 70-year-old female. With Colonial Penn, she would pay $65.68 each month and Americo would cost $65.60 monthly. AIG would cost her $74.52 per month and Prosperity would offer the cheapest burial life insurance cost of $59.13 a month.

Why such a big difference in cost for burial insurance? It comes down to the company. For instance, Colonial Penn offers units of life insurance based on your age instead of a coverage amount. Though the rates look cheap, you get very little coverage for that price. Companies with a higher cost for burial life insurance usually come with added benefits you don’t have to pay extra for. AIG is the most expensive, but it offers free living benefits coverage for chronic and terminal illness.

Compare and buy

final expense

What Is the Cheapest Burial Insurance?

The cheapest burial insurance depends on your age and health status. Burial insurance for seniors starts at $5,000 in coverage, which would be the cheapest coverage amount available.

If you are in good health, you can probably qualify for cheap burial insurance coverage with a larger death benefit.

If you give us a call at Final Expense Direct and let us know your budget, we can help you get the most amount of burial life insurance for the cheapest price after you answer a few health questions.

Burial Insurance vs. Term Life Insurance: Average Rates for a 50-Year-Old Male

If you’re a healthy 50-year-old male, you can probably get better average rates with term life insurance than you can with burial insurance. You might also get more coverage with term life insurance for a cheaper rate, but the policy expires after a set amount of years.

Burial insurance is a permanent whole life insurance policy with fixed premiums and death benefit for the rest of your life. Burial insurance for seniors is capped at $50,000 in coverage, but you might qualify for over $1 million in term life insurance coverage if you are healthy enough.

4 Types of Funeral Insurance Premiums

A funeral insurance premium is the amount you agree to pay for your life insurance policy. Most often, it is a monthly premium, but you can also pay quarterly, semi-annually, or annually. There are 4 types of funeral insurance premiums.

Stepped Premiums

With stepped premiums, your next year’s premium is calculated at each renewal. The amount you pay is based on your age, gender, and how much coverage you have. This is the most expensive type of funeral insurance premium because it increases every year as you get older.

Leveled Premiums

When you take out a final expense policy with leveled premiums, you lock in the same rate for life. The rate is based on your age, gender, and amount of coverage at the time of application. As long as you pay your premiums on time, they will NOT increase.

Capped Premiums

Some burial insurance premiums are capped, which means after you reach a certain age or monetary limit, the policy is considered paid in full. Even though you no longer have to make premium payments, your policy coverage stays in effect until you die.

Payout Guarantee Premiums

A burial insurance policy with payout guarantee premiums pays your beneficiary a guaranteed amount when you die. They will receive the higher amount of either the premiums you paid into the policy or the death benefit amount listed in the policy.

Whatever you think final expense costs...

It's probably less.

No money down • No medical exam

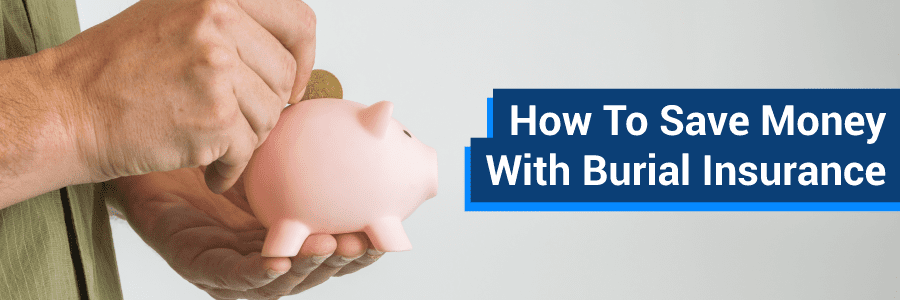

What’s the Difference Between Burial Insurance and Other Life Insurance?

Burial insurance is life insurance for seniors who only need a maximum of $50,000 in coverage. Burial insurance is a type of whole life insurance that offers permanent coverage at a fixed price.

There are several other types of life insurance, which are either temporary or permanent policies. Some offer flexibility with premiums and coverage amounts, while others expire or get really expensive after a certain amount of time.

Burial Insurance vs. Pre-Need Funeral Insurance

Burial insurance differs from pre-need funeral insurance and is often a better deal. With pre-need funeral insurance, you pick out all the details of your funeral, the funeral home determines the total cost, and you pay for a plan to cover the funeral costs.

With burial insurance, you get between $5,000 and $50,000 in whole life insurance. You designate a beneficiary, pay fixed premiums, and when you die, your beneficiary gets the death benefit coverage amount. They can use the death benefit for any purpose, including paying for your funeral costs.

Is Burial Insurance Worth It?

Burial insurance is worth it if your family can’t easily pay for your funeral when you die.

Burial insurance:

Is easy to qualify for

Comes in several policy types

Keeps your savings account intact for other needs

If your loved ones would be financially burdened by paying for your funeral and other debts after you die, wouldn’t burial insurance be worth it to you?

What are the Best Burial Insurance Companies for Seniors?

There are several burial insurance companies we consider the best for seniors. However, your needs for burial insurance will determine which company is the best for you.

Here are some standout features about some of our best burial insurance companies for seniors.

Best Simplified Issue Burial Insurance Companies for Seniors

The Baltimore Life Companies: If you need more than $40,000 in burial insurance, The Baltimore Life Companies may be the best option. Baltimore Life offers up to $150,000 in burial life insurance for seniors up to age 80.

Pioneer American: Our preferred burial insurance company for veterans, Pioneer American works with many health conditions, offering an immediate death benefit for diagnoses such as bipolar and PTSD. You can also add valuable waivers to customize your coverage, like premium waivers for nursing home confinement.

American Home Life Insurance Company: Another option for seniors with serious health issues, American Home Life covers seniors up to age 35 with coverage capped at $35,000. However, if you have more than one major health condition, you probably won’t be approved by American Home Life.

Liberty Bankers Life: There’s a lot to like about Liberty Bankers Life. It offers coverage to adults as young as 18, has a quick interview process and generous underwriting guidelines. You can also get family coverage for pennies with its child and grandchild riders.

Prosperity Life Group: Prosperity Life Group als has generous underwriting guidelines and a quick application process. Unlike other carriers, Prosperity will give an immediate death benefit to organ transplant recipients if it’s been over two years. Others will automatically decline coverage.

Royal Neighbors of America: Senior men and women can qualify for simplified issue or guaranteed acceptance burial insurance from Royal Neighbors of America. Get up to $30,000 in burial insurance coverage for seniors with a free accelerated death benefit rider.

Best Guaranteed Acceptance Burial Insurance Companies for Seniors

AIG: We recommend AIG for seniors in poor health who don’t need more than $25,000 in coverage. AIG is ultra competitive for guaranteed issue burial insurance, which doesn’t require a medical exam or health questions.

Mutual of Omaha: Another option for guaranteed issue burial insurance for seniors is Mutual of Omaha. This carrier also has guaranteed coverage with fast claims processing and an easy online application to apply for coverage.

Great Western Insurance Company: Another guaranteed issue burial insurance option for seniors is Great Western. They offer a free terminal illness rider on all policies and if you can answer no to three health questions, you can increase your death benefit by 25 percent.

As you can see, there are lots of options available for seniors interested in burial insurance. If you’re still not sure which company is best for you, call us today at Final Expense Direct. Our agents can help you choose the right policy for you and your budget.

Burial Insurance FAQ

Can you buy burial insurance?

Yes, you can buy burial insurance. This type of life insurance is made for seniors who need a small amount of life insurance to cover end-of-life expenses and funeral costs.

How burial insurance works?

Burial insurance works by paying a designated beneficiary a lump sum of money in exchange for the policyholder’s on-time premium payments. Once the insured dies, the insurance company will pay the death benefit amount to the beneficiary based on the contract details.

How do I get burial insurance?

You can get burial insurance by calling Final Expense Direct at 1-877-674-0236. We focus only on burial insurance, working with the best final expense life insurance companies to offer affordable burial life insurance for seniors.

What is burial insurance used for?

Burial insurance is used for funeral costs and end-of-life expenses. Funeral insurance, another name for burial insurance, is life insurance for seniors who need a small amount of life insurance to ease their family’s financial burden when they pass.

What's the best burial insurance?

The best burial insurance is different for everyone, based on the insured’s age, health, and coverage needs. The best burial insurance offers the amount of coverage you need for final expenses at a price you can afford.

Where can I purchase burial insurance?

You can purchase burial insurance from life insurance companies who offer final expense insurance. At Final Expense Direct, we work with the best burial life insurance companies, helping you to get coverage in just one phone call.

Who needs burial insurance?

Seniors burial insurance who want to pay for their funeral expenses and end-of-life bills need burial insurance.

Who qualifies for burial insurance for seniors?

Seniors can qualify for burial insurance, regardless of health status. There are several types of burial insurance for seniors, and the type you qualify for depends on how healthy you are when you apply.

Yes, preneed funeral insurance is different from burial insurance. Preneed funeral insurance is a prepaid you set up with the funeral home, where you pick each element of your funeral and purchase a plan for the total cost.How to buy burial insurance for parents?

If you want to buy burial insurance for your parents, we can help you get the right policy at Final Expense Direct. While you can buy burial insurance for your parents, they have to sign a consent form authorizing you to purchase it on their behalf.

Do I need burial insurance if I am younger?

If you are younger, you need traditional life insurance, not burial insurance. Burial insurance is life insurance for seniors, and you can get a lot more coverage at a better price if you buy term life insurance.

How is burial insurance different from regular whole life insurance?

Burial insurance is whole life insurance, but it’s different because it’s designed for seniors and has a limited amount of coverage you can buy.

Whatever you think final expense costs...

It's probably less.

No money down • No medical exam

How is burial insurance different from funeral insurance?

Burial insurance is different from funeral insurance because it’s not as limited. Burial insurance is a whole life insurance policy for seniors. Funeral insurance is a prepaid plan you set up with a funeral home to pay for funeral costs before you die.

Does life insurance cover burial costs?

Yes, life insurance covers burial costs—if the beneficiary pays for the costs using the death benefit. Once a beneficiary receives life insurance proceeds, the funds can pay for anything, including funeral and burial costs.

Is burial insurance worth buying?

Burial insurance is worth buying if you don’t want to financially burden your loved ones with your funeral costs and other debts. If you buy burial insurance, your family and friends can focus on grieving your loss instead of trying to come up with the money to pay for your funeral.

What is covered by burial insurance?

What is covered by burial insurance depends on how much coverage your senior life insurance policy has. Burial insurance can cover funeral or cremation costs and pay off medical debt and other end-of-life expenses.

Is burial insurance the same as life insurance?

Burial insurance is the same as life insurance—it’s a specific type of life insurance. Burial insurance is life insurance for seniors to pay for final expenses.

Does AARP offer burial insurance?

AARP does not offer burial insurance. AARP partners with New York Life to offer guaranteed acceptance life insurance up to $25,000 in coverage.

Is final expense insurance a good deal?

Final expense insurance is a good deal if you can afford to pay for the coverage. The cost of final expense insurance is based on your age, health, and where you live when you apply.

Who has the best burial insurance?

There are many life insurance companies that offer burial insurance. The company with the best burial insurance offers the most coverage at the cheapest rate based on your age and health.

How do final expense policies work?

Final expense policies work like other life insurance policies. In exchange for paid premiums, the life insurance company agrees to pay a predetermined death benefit to your beneficiary when you die.

Can I buy cremation insurance?

You can buy cremation insurance, but you may get a better deal if you buy burial or final expense life insurance to pay for your cremation.

Do funeral homes offer burial insurance?

Funeral homes may offer burial insurance, but they usually only work with one or two companies that pay them the highest commissions. You should get burial insurance from a company like Final Expense Direct because we work with a long list of insurance companies to get you the best price.

What are the Health Requirements for Burial Insurance and Final Expense Plans?

Burial insurance and final expense plans have different health requirements based on the type of life insurance you buy. If you're in poor health, you can get burial insurance without health questions or a medical exam.

What Happens if My Insurance Company Goes Out of Business?

If your insurance company goes out of business, your state insurance regulators step in to help. All states have an insurance guaranty association that requires insurance companies to pay into for this specific purpose.

Is a Medical Exam Required?

A medical exam is not always required, but if you are in good health, a medical exam can get you cheaper life insurance.

Is burial insurance different from preneed funeral insurance?

Yes, preneed funeral insurance is different from burial insurance. Preneed funeral insurance is a prepaid funeral plan you set up with the funeral home, where you pick each element of your funeral and purchase a plan for the total cost.

Do Funeral Homes Offer Burial Insurance?

Funeral homes may offer burial insurance, but most offer prepaid funeral plans instead. If a funeral home offers burial insurance, you usually only have one or two companies to choose from. The insurance company may not have your best interests in mind, focusing more on commission sales instead of offering you the best deal on burial insurance.

If you need burial insurance, you are better off working with an independent company like Final Expense Direct. We work with some of the best and most affordable senior life insurance companies to get you the most coverage you can afford.

What Is Prepaid Burial Insurance?

Prepaid burial insurance is a contract between you and the funeral home. You choose the details of your funeral; they tally up the cost, and you prepay the funeral costs in full or over time with payments.

If you want to prepay your funeral, be aware that if costs increase, your family may have to pay the balance once you die. You also aren’t protected for prepaid burial insurance the same way you are with a life insurance policy.

Alternatives to Traditional Burial Insurance

Depending on your age and health, there are alternatives to traditional burial insurance to consider. Weigh the different options to see which type of life insurance is best for you and your needs.

Term Life Insurance

Term life insurance is a temporary type of life insurance that is usually the most affordable. You get locked-in rates for 5 to 30 years for a fixed cost.

If you want to keep the policy when it expires, you will pay much higher rates at the age you are when it expires. Depending on the company and your health, you might be eligible for term life insurance as a senior if you are 60 or younger.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance. You can get a small amount of coverage or over $1 million in coverage.

Universal life insurance has flexible payments and may accrue cash value. You can also make adjustments to your death benefit amount, but that can affect your premium and cash value accumulation.

Guaranteed Issued Whole Life Insurance

Guaranteed issue whole life insurance is permanent life insurance you don’t have to qualify for. There are no health questions or medical exam required. If you can apply for and sign the application plus make the payments, you can get approved for guaranteed issue whole life insurance.

Pre-Paid Funeral

With a pre-paid funeral, you plan your funeral while you’re still alive and work out payment arrangements with the funeral home.

When you die, your funeral costs are already paid and the funeral home will honor your wishes. But, if funeral costs increase, your family might have to pay the difference if your payments don’t cover the funeral.

POD Account

A POD account, or payable on death account, is a bank account you set up with a named beneficiary. When you die, your beneficiary provides an original death certificate to the bank, and the bank account passes to the beneficiary.

POD accounts can be set up as:

Checking accounts

Savings accounts

Certificates of deposit (CD)

Money market accounts

U.S. savings bonds

Retirement Portfolio

If you have a retirement portfolio with an IRA account, you can designate part of the funds to pay for funeral costs. The IRS has guidelines set up for hardship distributions, which allow your family to withdraw funds for an immediate financial need, like paying for a funeral.

The Takeaway

Burial insurance is life insurance for seniors. The type of burial life insurance plan you qualify for depends on your age and health. Burial life insurance can pay for your funeral and final expenses, and whatever else your beneficiary chooses if there is money leftover.

If your death would financially burden someone you love, you should buy burial life insurance for seniors.