Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 26 Apr 2024

Seniors face more challenges when buying life insurance than any other age group. Their age means they pay more for life insurance coverage. If there are health issues, they can make it more expensive than a senior on a fixed income can afford.

Fidelity Life Insurance has been offering life insurance since 1896. Fidelity Life offers term life insurance and final expense insurance for seniors. They also offer whole life and accidental death insurance.

Fidelity calls itself an innovative leader in the industry. With so much time in the industry, you’d expect them to be one of the best.

But are they?

Today, we’re going to help you find out if they are the best choice for you.

Fidelity Final Expense Insurance

Final expense insurance is also called burial insurance or funeral insurance. It’s marketed mainly to seniors, but some companies offer it to younger age groups, too.

Though final expense insurance is usually sold to pay for end-of-life expenses, including funeral and medical bills, your beneficiary can use the proceeds for anything.

Fidelity offers two types of final expense insurance. How much coverage you need and your current health will determine which is the better option for you.

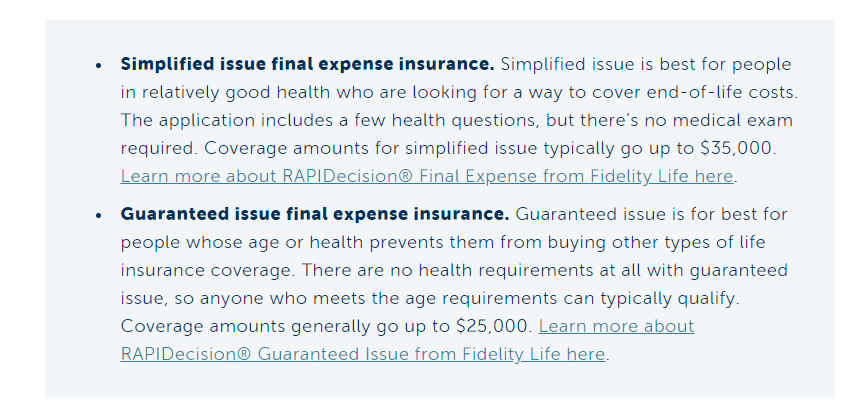

Fidelity Simplified Issue Final Expense Insurance

At Fidelity, you can get final expense insurance through a process called simplified issue. Unlike the traditional life insurance process, which requires a lot of health questions on the application and an invasive medical exam, simplified issue doesn’t require a medical exam.

You will still have to answer a few health questions, but not as many as a standard life insurance application. With no medical exam to complete, you can usually get approved in a few days instead of a few weeks — as long as you can answer “no” to the health questions.

What health questions will you have to answer? Well, you won’t find out until a Fidelity representative calls you.

You can get a quote online, but the system decides how much coverage you can apply for. For example, when we quoted a 60-year-old male in good health, the system told us we could only apply for up to $10,000 in final expense life insurance, but they offer up to $35,000.

Fidelity Life Guaranteed Issue Final Expense Insurance

If you have serious health issues, you might not qualify for simplified issue final expense insurance. That’s okay, because there’s always guaranteed issue. Like the name suggests, you’re guaranteed to be approved if you apply.

Fidelity offers final expense insurance to seniors aged 50-85. You can apply for up to $25,000 in guaranteed issue final expense insurance.

Once again, though, the online quote tool only offered us up to $10,000 in coverage. You also have to provide your personal information so a Fidelity Life rep can call you to sell you coverage.

Fidelity Burial Insurance

Like we said before, burial insurance is just another name for final expense life insurance. When you die, your beneficiary can pay for your burial, viewing, cemetery plot, or anything else with the death benefit.

If you can’t afford to pay for your burial, and you don’t want to burden your family and loved ones with the cost, you should consider buying final expense life insurance for seniors to pay for it.

Fidelity Life Insurance For Seniors

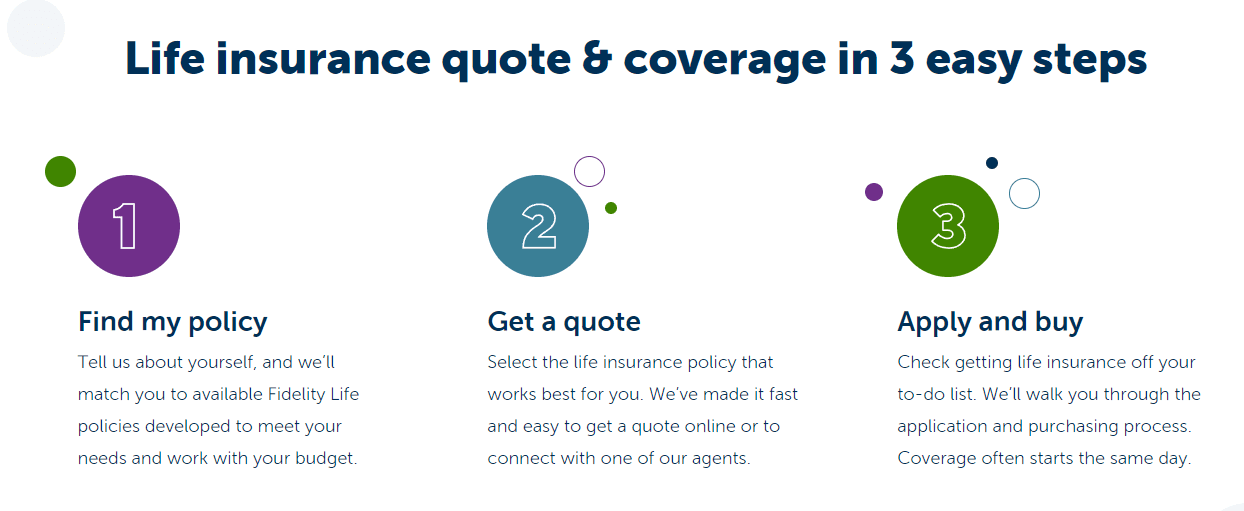

Buying life insurance for seniors should be an easy process. At Fidelity, you can get a quote online, but then you have to wait for an agent to call you. Or, you can call them, but with a big company like Fidelity, don’t expect personalized service. Instead, you’ll be dealing with an agent who wants to sell you the most coverage so they can get a big commission.

If you want personalized service and don’t want to deal with automated systems or pushy sales agents, we have a better solution for you.

Fidelity Senior Life Insurance

At Final Expense Direct, our agents are ready and waiting to speak with you. When you call, an agent will answer directly. They take the time to get to know you, your needs, and the best way to help you save the most on the coverage you need. You’re not just a number to us, but a living, breathing, God fearing American with a name that we’ll remember every time you call.

We work with the best life insurance companies to get you covered in just one phone call. We’ll ask you a few questions about your health and needs to help you choose the best plan, then get you approved that day.

Fidelity Funeral Insurance

Funerals can be expensive, with the average costing around $8,800. Add in an urn, cemetery plot, and other services and you’re looking at $10,000 or more for a proper burial and funeral. Even if you choose cremation, you’re only looking at saving a couple grand at most, unless you forgo all the extras.

Funeral homes offer funeral insurance or prepaid funerals, but they won’t shop around to get your best final expense rate. And if you prepay for your funeral and live for several more years, inflation could mean your family is on the hook to pay the rest.

Instead of buying expensive funeral insurance, call Final Expense Direct so we do all the shopping for you to get you the best rate.

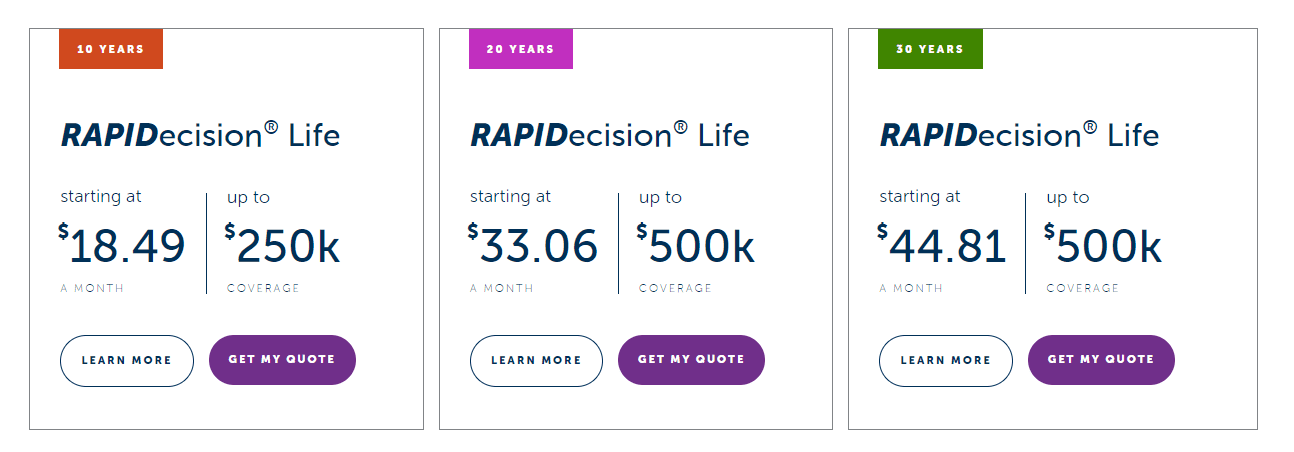

Fidelity Life Insurance Costs

So, what’s the cost of life insurance with Fidelity compared to other companies?

When we ran the quotes, a 50-year-old man would pay $38 a month for coverage with Fidelity. A woman of the same age would only pay $29 because women are less risky to insure and have a longer life expectancy than men.

If you think you need life insurance to pay for your final expenses, you should get it sooner than later. If you’re a man, waiting until you’re 55 would increase the cost to $45 a month, and waiting until 60 would cost you $52 monthly for the same coverage.

Now, let’s compare that to another final expense life insurance company with decades in the business.

Fidelity vs. Mutual of Omaha

With Mutual of Omaha, the same 50-year-old man would pay just $29 per month for the same coverage. A female would pay only $24 a month. Instead of paying $52 with Fidelity at 60-years-old, you’d only pay $43 per month with Mutual of Omaha.

Related Reading: Senior Legacy Life Insurance vs Senior Legacy Life— What's the difference?

Mutual of Omaha also offers final expense insurance as young as 45 and coverage up to $40,000. With better rates, more available coverage, and younger coverage age, Mutual of Omaha may be the better choice compared to Fidelity.

A Must Read: The Best Final Expense Insurance Companies

Not only is Mutual of Omaha cheaper, they also have fewer complaints against them. In 2020, Fidelity’s complaint index with the National Association of Insurance Commissioners was 2.84. That’s nearly three times higher than the industry average of 1.00.

Mutual of Omaha’s complaint index was only 1.20. That’s just a bit higher than the industry average. The lower the complaint index, the better the customer service and more likely your beneficiary won’t have to jump through unnecessary hoops to get paid the death benefit.

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Conclusion

If you want until you’re a senior to buy life insurance, it can be expensive. But that shouldn’t stop you from buying it if you need it.

At Final Expense Direct, we work with some of the best final expense life insurance companies across the country, not just Mutual of Omaha.

The companies we partner with offer affordable rates for the coverage you need and we can get you approved in just one phone call.

Our mission is to offer you peace of mind so you can focus on living out your golden years, knowing that when the good Lord calls you home, your loved one’s won’t have to shoulder the financial burden alone.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?