Written by Kim Wilhelm

Verified! See guidelines

Verified! See our editorial guidelines

Last Updated 29 Apr 2024

When you think of AAA, you probably think of roadside assistance. But AAA is more than just a company that helps you replace a tire, bring you gas if you run out, or tow you home.

AAA also offers several types of insurance, including life insurance.

Seniors looking for life insurance have many companies to choose from and they all have their pros and cons.

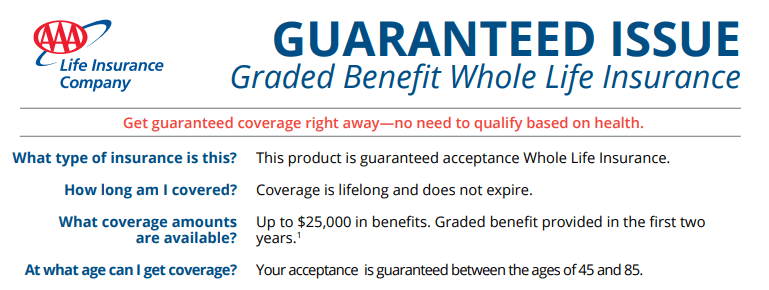

AAA offers guaranteed life insurance for seniors coverage in amounts up to $25,000.

If you’re a senior without life insurance and you’re considering buying it, you may wonder if AAA's life insurance is worth it.

Here’s what you need to know about AAA life insurance and how it stands up to some other well-known competitors.

AAA Final Expense Insurance

Life insurance marketed to seniors is usually called final expense insurance. This type of life insurance is whole life insurance, which offers permanent coverage for your lifetime.

Other features include:

- Locked-in premiums for life

- Coverage that never decreases

- Cash value that builds over time

- Rates that aren’t affected by your health or age

AAA Burial Insurance

Another name for final expense insurance is burial insurance. Just like end-of-life costs, burial costs can vary widely. Where you live, the type of burial you want, and any extras like a full service, with all the bells and whistles, can really add up.

If you can pay for everything out of your savings or retirement account, you might not need to buy final expense or burial insurance.

But if you can’t, or you don’t want to make your family pay, then you should probably consider final expense insurance. You can get coverage regardless of your age and health, even if you’re a smoker.AAA Life Insurance For Seniors

Buying life insurance for seniors can seem complicated, especially if you aren’t sure what kind of coverage you need or what you qualify for. If you want to apply for AAA life insurance for seniors, you’ll have to do it by phone or through the mail.

One thing you may not be aware of is that all life insurance companies set their own rates. So, even if they offer the same type of life policy as AAA, other companies could have better prices.

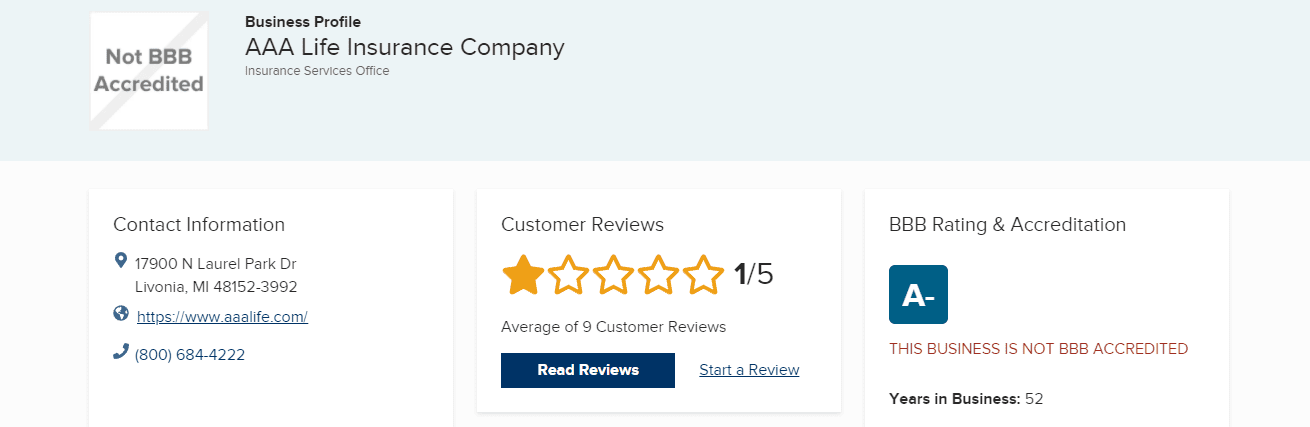

Sure, you can go with AAA if you want. But AAA is more well known for roadside assistance, auto, and home insurance.

If you want the best coverage at the best price, you might be better off going with a company that really knows life insurance.

The rates are more expensive for guaranteed issue final expense insurance because they’re only based on your age and coverage amount. But, if you’re in poor health with at least one , it’s your best option at getting permanent life insurance that locks in your rates and coverage.

AAA Senior Life Insurance

Seniors rarely need as much life insurance as younger age groups, which is why final expense senior life insurance is a great choice.

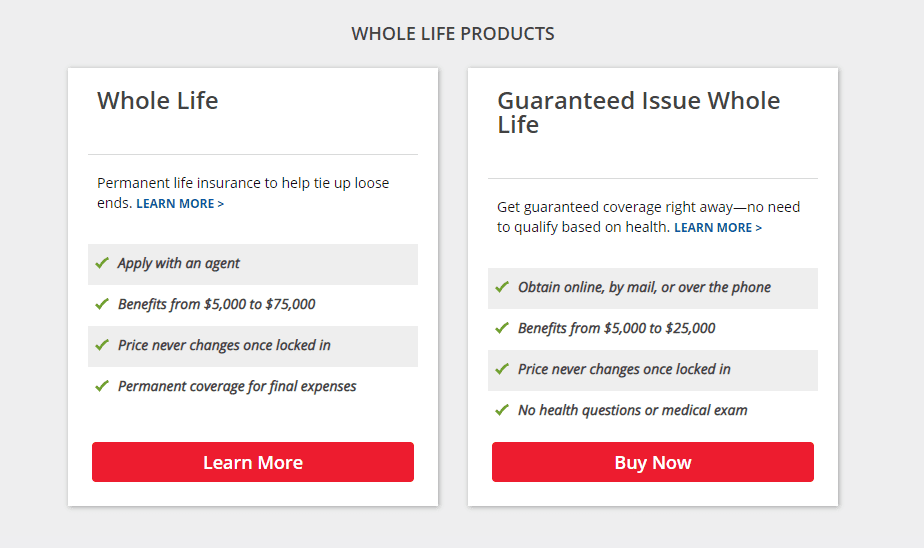

Depending on how healthy you are, you have two choices for senior life insurance: simplified issue or guaranteed issue.

AAA doesn’t offer simplified issue life insurance. If you’re relatively healthy, you can probably qualify for simplified issue, which would be cheaper than the type of life insurance you can get from AAA.

With simplified issue life insurance, you have to answer a few questions about your health. If you’re approved, you can get the cheapest rates offered on final expense senior life insurance.

If you aren’t in great health, maybe you’re overweight, have heart disease, or high blood pressure, then you might be a better fit for AAA senior life insurance.

AAA offers guaranteed acceptance whole life insurance, which means as long as you fall in the right age group — 45 to 85 — then you’re guaranteed to be accepted, no matter your health or smoking status.

pre-existing conditionAAA Funeral Insurance

Funerals can be expensive, especially when you factor in an urn for cremation or casket for burial. Plus, you’ll pay for the funeral home service, clergy, transportation to the gravesite, and any other things you want for your final send off.

It can easily cost $10,000 or more, which many seniors don’t have lying around. Some funeral homes offer prepaid funeral plans, which allow you to set up a payment plan for the total cost of your funeral.

If you don’t want to be in that position, you’re better off buying final expense insurance, also called . You can make whoever you want the beneficiary, and they can use the to pay for your funeral. Set up just how you want.

However, funeral costs can increase over time, and if it’s years before you die, your loved one’s may be stuck paying the difference before they’ll finalize your last wishes.

AAA Life Insurance Costs

Now, let’s talk about life insurance costs. A guaranteed issue life insurance policy is the most expensive, and what AAA offers for seniors. How old you are is one of the deciding price factors, and not all companies are competitive at all ages.

Let’s compare two guaranteed issue final expense companies at different ages to see how they compare to AAA.

AAA vs. AIG

With AAA, a 50-year-old male would pay $59 per month for a $10,000 final expense policy. For the same policy with AIG — a longtime leader in the life insurance industry — you’ll only pay $52 per month.

A woman of the same age would pay $47 per month for the same policy with AAA. But with AIG, she’d only pay $36 each month.

If you’re paying for this policy for years and potentially decades, those dollars can really add up.

AAA vs. Mutual of Omaha

Now, let’s look at a 70-year-old man and woman with AAA compared to Mutual of Omaha, another long-standing life insurer with over 100 years’ experience.

The monthly rate for him would be $98 with AAA but only $87 with Mutual of Omaha. Likewise, she would pay $77 each month with AAA, while Mutual of Omaha would only charge $64 for the same policy.

As you can see in both examples, AIG and Mutual of Omaha have superior rates to AAA for the same coverage. At Final Expense Direct, we work with industry leaders like AIG and Mutual of Omaha to provide the best final expense life insurance based on your age, coverage needs, and health.

Call us or get a quote online today to find out which company will offer you the best price on final expense insurance. We want you to get the best coverage while saving the most amount of money, and we have a long list of companies to bring you peace of mind.

Related: Be Wary of the T-2 Form

- Immediate Approval Over the Phone Today!

- Speak to a Live Agent

- Just a Few Health Questions

Conclusion

While AAA offers final expense life insurance, so do a lot of other companies who have been in the life industry longer.

Why not go with a company that has competitive rates, focusing only on life insurance?

Call us today at Final Expense Direct so we can help you find the right policy and get you covered, all before we hang up the phone.

Other Final Expense Company Reviews:

- Nationwide Insurance Review

- Amica Insurance Review

- Bestow Life Insurance Review

- Aetna Insurance Review

- American Amicable Life Insurance

- Haven Life Insurance Review

- Royal Neighbors of America Insurance Review

- Mutual of Omaha Life Insurance Review

- AIG Life Insurance Review

- Fidelity Life Insurance Review

- Globe Life Insurance Review

- AARP Life Insurance Review

- Metlife Life Insurance Review

- Colonial Penn Life Insurance Review

- Lifeinsurancesavings.com Life Insurance Review

- National Family Life Insurance Review

- Great Western Insurance Company Review

- The Baltimore Companies Insurance Review

- Liberty Bankers Life Insurance Review

- Prosperity Life Group Review

- American Home Life Insurance Review

- Pioneer American Life Insurance Review

- AAA Burial Insurance Review

- State Farm Burial Insurance Review

- Americo Life Insurance

- Gerber Life Insurance Review

- United Freedom Benefits Review

- Trustage Life Insurance Review

- USA Family Protection

- ReliaStar Life Insurance

- Physicians Life Insurance

- Trinity Life Insurance

- Banner Life Insurance

Related:

The Lord Is Calling Me Home - What Happens If You Die With No Money And No Life Insurance?